BetaFin, a financial services firm, does not have retail branches, but has fixed income, equity, and asset management divisions. Which one of the four following risk and control self-assessment (RCSA) methods fits the firm's operational risk framework the best?

What is a common implicit assumption that is made when computing VaR using parametric methods?

Which one of the following is a reason for a bank to keep a commercial loan in its portfolio until maturity?

I. Commercial loans usually have attractive risk-return profile.

II. Commercial loans are difficult to sell due to non standard features.

III. Commercial loans could be used to maintain good relations with important customers.

IV. The credit risk in commercial loans is low.

Which one of the following four statements about economic capital of a bank is correct?

Which of the following statements describes a bank's reasons to set risk limits?

I. To control and minimize a bank's current risk exposure.

II. To predict future risks.

III. To allocate risks to business units.

IV. To keep risk within tolerance levels.

Banks duration match their assets and liabilities to manage their interest risk in their banking book. A bank has $100 million in interest rate sensitive assets and $100 million in interest rate sensitive liabilities. Currently the bank's assets have a duration of 5 and its liabilities have a duration of 2. The asset-liability management committee of the bank is in the process of duration-matching. Which of the following actions would best match the durations?

Short-selling is typically associated with the following risks:

I. Potential for extreme losses

II. Risk associated with the availability of shares to borrow

III. Market behavior risk

IV. Liquidity risk

The market risk manager of SigmaBank is concerned with the value of the assets in the bank's trading book. Which one of the four following positions would most likely be not included in that book?

Banks duration match their assets and liabilities to manage their interest risk in their banking book. Currently, the bank's assets and liabilities both have a duration of 10. To hedge against the risk of decreasing interest rates, the bank should

I. Increase the duration of the liabilities

II. Increase the duration of the assets

III. Decrease the duration of the liabilities

IV. Decrease the duration of the assets

SigmaBank has many branches that offer the same products and services. Which one of the four following statement presents an advantage of using RCSA questionnaire approach in the SigmaBank's operational risk framework?

Which one of the following four statements presents a challenge of using external loss databases in the operational risk framework?

Which one of the following four statements regarding floating rate bonds is incorrect?

Which one of the following four statements about the "market-maker" trading strategy is INCORRECT?

The probability of default on a bond is 3%, and in the case of default, investors expect to lose 70% of their investment. The bond's risk premium is 1.9%. The expected loss and the credit spread of the bond are, respectively:

Which one of the four following statements about technology systems for managing operational risk event data is incorrect?

If the yield on the 3-month risk free bonds issued by the U.S government is 0.5%, and the 3-month LIBOR rate is 2.5%, what is the TED spread?

Which of the following statements describes correctly the objectives of position mapping ?

Which one of the following four statements regarding commodity derivative risks is INCORRECT?

Over a long period of time DeltaBank has amassed a large equity option position. Which of the following risks should be considered in this transaction?

I. Counterparty risk on long OTC option positions

II. Counterparty risk on short OTC option positions

III. Counterparty risk on long exchange-traded option positions

IV. Counterparty risk on short exchange-traded option positions

Mega Bank has $100 million in deposits on which it pays 3% interest, and $20 million in equity on which it pays no interest. The loan portfolio of $120 million earns an average rate of 10%. If the rates remain the same and Mega Bank is able to earn the same net interest income in perpetuity at a 5% discount rate, what will the present value of this holding be?

Which one of the following four regulatory drivers for operational risk management includes risk and control requirements for financial statements in the United States?

Alpha Bank, a small bank,has a long position with larger BetaBank and has an identical short position with another larger bank GammaBank. Each large bank requires a 20% initial collateral to support the trade. As prices fluctuate in either direction, one large bank will require additional collateral from the small bank, while the risk of loss to the other large bank will increase. By running the trades through a clearinghouse, the small bank can achieve all of the following objectives EXCEPT:

A risk associate responsible for the operational risk function wants to evaluate the upward reporting governance structure and to assess its critical features. Which one of the four attributes does not represent a critical feature of the upward reporting governance structure?

BetaFin has decided to use the hybrid RCSA approach because it believes that it fits its operational framework. Which of the following could be reasons to use the hybrid RCSA method?

I. BetaFin has previously created series of RCSA workshops, and the results of these workshops can be used to design the questionnaires.

II. BetaFin believes that using the questionnaire approach should be more useful.

III. BetaFin had used the questionnaire approach successfully for certain businesses and the workshop approach for others.

IV. BetaFin had already implemented a sophisticated RCSA IT-system.

A bank has a Var estimate of $100 million. It is considering a new transaction which has a correlation of 0.35 with the current portfolio and a standalone VaR estimate of $5 million. What would be the new VaR for the bank if it carried out the transaction?

The retail banking business of BankGamma has an expected P & L of $50 million and a VaR of $100 million. The bank seeks to diversify its revenue, and is considering the opportunity to acquire a credit card business with an expected P & L of $50 million and a VaR of $150 million. What will be the overall RAROC if the bank acquires the new business?

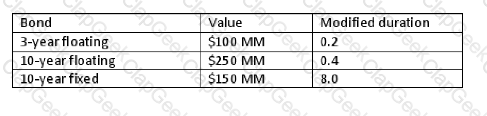

A portfolio consists of two floating rate bonds and one fixed rate bond.

Based on the information below, modified duration of this portfolio is

Gamma Bank has $300 million in loans and $200 million in deposits. If the modified duration of the loans is estimated to be 2, and the modified duration of the deposits is estimated to be 1, then the change in Gamma Bank's equity value per 1% change in yield will be:

When the cost of gold is $1,100 per bullion and the 3-month forward contract trades at $900, a commodity trader seeks out arbitrage opportunities in this relationship. To capitalize on any arbitrage opportunities, the trader could implement which one of the following four strategies?

James Johnson bought a coupon bond yielding 4.7% for $1,000. Assuming that the price drops to $976 when yield increases to 4.71%, what is the PVBP of the bond.

Unico Bank, concerned with managing the risk of its trading strategies, wants to implement the trading strategy that exposes the bank to the lowest market risk. Which one of the following four strategies should Unico take to limit its risk exposure?

DeltaFin wants to develop a control scoring method for its RCSA program. Which of the following statements regarding scoring methods are correct?

I. DeltaFin can develop a control scoring method that assesses both the design and the performance of the control.

II. DeltaFin can combine the design and performance scores for each control to produce an overall control effectiveness score.

III. DeltaFin can use the control performance scores to compute an overall risk severity score.

IV. DeltaFin can determine its own appropriate control scoring method.

The Basel II Accord's operational risk definition excludes all of the following items EXCEPT:

A risk analyst is considering how to reduce the bank's exposure to rising interest rates. Which of the following strategies will help her achieve this objective?

I. Reducing the average repricing time of its loans

II. Increasing the average repricing time of its deposits

III. Entering into interest rate swaps

IV. Improving earnings capacity and increasing intermediated funds

Which one of the four following statements about back testing the VaR models is correct?

Back testing requires

Which of the following are conclusions that could be drawn from the shape of the statistical distribution of losses that a bank might incur over a future time period?

I. In most years a bank would look more profitable than it will be on average.

II. Most of the time a sufficiently well capitalized bank will appear over-capitalized.

III. Bad years do not come along very often, but when they do they lead to enormous losses.

Which of the following factors are typically included in standard operational risk definitions?

I. Human errors

II. Process failure

III. Systems failure

IV. Unexpected events

Which one of the following four statements about planning for the operational risk framework is INCORRECT?

Which of the following are the most common methods to increase liquidity in stressed conditions?

I. Selling or securitizing assets.

II. Obtaining additional credit lines.

III. Securing a better credit rating.

A risk analyst at EtaBank wants to estimate the risk exposure in a leveraged position in Collateralized Debt Obligations. These particular CDOs can be used in a repurchase transaction at a 20% haircut. If the VaR on a $100 unleveraged position is estimated to be $30, what is the VaR for the final, fully leveraged position?

In analyzing the historical performance of a financial product, you are concerned about "fat tails", the probability of extreme returns compared to realized returns. Which of the following measures should you use to determine if the product return distribution of the product has "fat tails"?

Floating rate bonds typically have ________ duration which means they have ________ sensitivity to interest rate changes.

Company A needs to provide a risk probability/frequency score for its RCSA program. If the event is likely to happen once in 2 years, then the frequency score will be equal to:

Which of the following statements represents a methodological difference between variance-covariance and full revaluation methods?

Which of the following statements is a key difference between customer loans and interbank loans?

Which one of the following four statements on factors affecting the value of options is correct?

According to a Moody's study, the most important drivers of the loss given default historically have been all of the following EXCEPT:

I. Debt type and seniority

II. Macroeconomic environment

III. Obligor asset type

IV. Recourse

Which one of the following four options is NOT a typical component of a currency swap?

Which one of the following four features is NOT a typical characteristic of futures contracts?

Gamma Bank provides a $100,000 loan to Big Bath retail stores at 5% interest rate (paid annually). The loan also has an annual expected default rate of 2%, and loss given default at 50%. In this case, what will the bank's expected loss be? What is the expected loss of this loan?

A credit portfolio manager analyzes a large retail credit portfolio. Which of the following factors will represent typical disadvantages of market-linked credit risk drivers?

I. Need to supply a large number of input parameters to the model

II. Slow computation speed due to higher simulation complexity

III. Non-linear nature of the model applicable to a specific type of credit portfolios

IV. Need to estimate a large number of unknown variable and use approximations

Typically, which one of the following four option risk measures will be used to determine the number of options to use to hedge the underlying position?

Which one of the following four statements correctly defines a non-exotic call option?

A risk manager analyzes a long position with a USD 10 million value. To hedge the portfolio, it seeks to use options that decrease JPY 0.50 in value for every JPY 1 increase in the long position. At first approximation, what is the overall exposure to USD depreciation?

Which one of the following statements correctly identifies risks in foreign exchange forwards?

A large energy company has a recurring foreign currency demands, and seeks to use options with a pay-off based on the average price of the underlying asset on either a few specific chosen dates or all dates within a specific pricing window. Which one of the following four option types would most likely meet these specific foreign currency demands?

Which one of the following four features is NOT a typical characteristic of futures contracts?

The pricing of credit default swaps is a function of all of the following EXCEPT:

Which one of the four following statements regarding foreign exchange (FX) swap transactions is INCORRECT?

Which one of the following statements correctly identifies risks in foreign exchange forwards?

Gamma Bank provides a $100,000 loan to Big Bath retail stores at 5% interest rate (paid annually). The loan is collateralized with $55,000. The loan also has an annual expected default rate of 2%, and loss given default at 50%. In this case, what will the bank's expected loss be?

A risk manager has a long forward position of USD 1 million but the option portfolio decreases JPY 0.50 for every JPY 1 increase in his forward position. At first approximation, what is the overall result of the options positions?

Which one of the following four metrics represents the difference between the expected loss and unexpected loss on a credit portfolio?

To quantify the aggregate average loss for the credit portfolio and its possible constituent subportfolios, a credit portfolio manager should use the following metric:

A risk manager is analyzing a call option on the GBP with a vega of 0.02. When the perceived future volatility increases by 1%, the call option

Changes to which one of the following four factors would typically not increase the cost of credit?

Alpha Bank determined that Delta Industrial Machinery Corporation has 2% change of default on a one-year no-payment of USD $1 million, including interest and principal repayment. The bank charges 3% interest rate spread to firms in the machinery industry, and the risk-free interest rate is 6%. Alpha Bank receives both interest and principal payments once at the end the year. Delta can only default at the end of the year. If Delta defaults, the bank expects to lose 50% of its promised payment.

What may happen to the Delta's initial credit parameter and the value of its loan if the machinery industry experiences adverse structural changes?

After entering the securitization business, Delta Bank increases its cash efficiency by selling off the lower risk portions of the portfolio credit risk. This process ___ return on equity for the bank, because the cash generated by the risk-transfer and the overall ___ of the bank's exposure to the risk.

Which one of the following four statements on the seniority of corporate bonds is incorrect?

Which one of the following four mathematical option pricing models is used most widely for pricing European options?

According to the largest global poll of foreign exchange market participants, which one of the following four global financial institutions was the most active participant in the global foreign exchange market?

Of all the risk factors in loan pricing, which one of the following four choices is likely to be the least significant?

As DeltaBank explores the securitization business, it is most likely to embrace securitization to:

I. Bring transparency to the bank's balance sheet

II. Create a new profit center for the bank

III. Strategically release risk capital and regulatory capital for redeployment

IV. Generate cash for additional debt origination

A financial analyst is trying to distinguish credit risk from market risk. A $100 loan collateralized with $200 in stock has limited ___, but an uncollateralized obligation issued by a large bank to pay an amount linked to the long-term performance of the Nikkei 225 Index that measures the performance of the leading Japanese stocks on the Tokyo Stock Exchange likely has more ___ than ___.

For which one of the following four reasons do corporate customers use foreign exchange derivatives?

I. To lock in the current value of foreign-denominated receivables

II. To lock in the current value of foreign-denominated payables

III. To lock in the value of expected future foreign-denominated receivables

IV. To lock in the value of expected future foreign-denominated payables

After entering the securitization business, Delta Bank increases its cash efficiency by selling off the lower risk portions of the portfolio credit risk. This process ___ risk on the residual pieces of the credit portfolio, and as a result it ___ return on equity for the bank.

ThetaBank has extended substantial financing to two mortgage companies, which these mortgage lenders use to finance their own lending. Individually, each of the mortgage companies has an exposure at default (EAD) of $20 million, with a loss given default (LGD) of 100%, and a probability of default of 10%. ThetaBank's risk department predicts the joint probability of default at 5%. If the default risk of these mortgage companies were modeled as independent risks, what would be the probability of a cumulative $40 million loss from these two mortgage borrowers?

An options trader is assessing the aggregate risk of her currency options exposures. As an options buyer, she can potentially ___ lose more than the premium originally paid. As an option seller, however, she has a ___ risk on the contract and always receives a premium.

Which one of the following changes would typically increase the price of a fixed income instrument, such as a bond?

Which one of the following four global markets for financial assets or instruments is widely believed to be the most liquid?

A credit analyst wants to determine a good pricing strategy to compensate for credit decisions that might have been made incorrectly. When analyzing her credit portfolio, the analyst focuses on the spreads in each loan to determine if they are sufficient to compensate the bank for all of the following costs and risks EXCEPT.

Which one of the following four statements about the relationship between exchange rates and option values is correct?

Alpha Bank determined that Delta Industrial Machinery Corporation has 2% change of default on a one-year no-payment of USD $1 million, including interest and principal repayment. The bank charges 3% interest rate spread to firms in the machinery industry, and the risk-free interest rate is 6%. Alpha Bank receives both interest and principal payments once at the end the year. Delta can only default at the end of the year. If Delta defaults, the bank expects to lose 50% of its promised payment. What interest rate should Alpha Bank charge on the no-payment loan to Delta Industrial Machinery Corporation?

To estimate a partial change in option price, a risk manager will use the following formula:

What is the explanation offered by the liquidity preference theory for the upward sloping yield curve shape?

Which of the following factors can cause obligors to default at the same time?

I. Obligors may be harmed by exposures to similar risk factors simultaneously.

II. Obligors may exhibit herd behavior.

III. Obligors may be subject to the sampling bias.

IV. Obligors may exhibit speculative bias.

Which one of the following four metrics represents the difference between the expected loss and unexpected loss on a credit portfolio?

Altman's Z-score incorporates all the following variables that are predictive of bankruptcy EXCEPT:

Which one of the following four parameters is NOT a required input in the Black-Scholes model to price a foreign exchange option?

Which one of the following four options correctly identifies the core difference between bonds and loans?

The value of which one of the following four option types is typically dependent on both the final price of its underlying asset and its own price history?

When a credit risk manager analyzes default patterns in a specific neighborhood, she finds that defaults are increasing as the stigma of default evaporates, and more borrowers default. This phenomenon constitutes

Which one of the following four exotic option types has another option as its underlying asset, and as a result of its construction is generally believed to be very difficult to model?

In the United States, during the second quarter of 2009, transactions in foreign exchange derivative contracts comprised approximately what proportion of all types of derivative transactions between financial institutions?

Which one of the following four models is typically used to grade the obligations of small- and medium-size enterprises?