A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of the design contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

When analyzing a precedence diagram schedule, the "backward pass"

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

The main financial objective of many enterprises is:

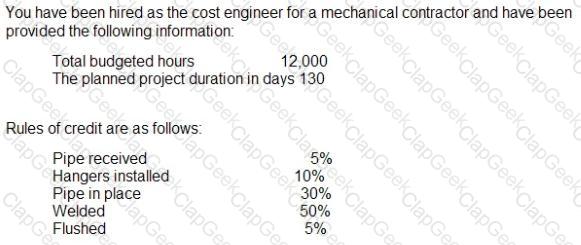

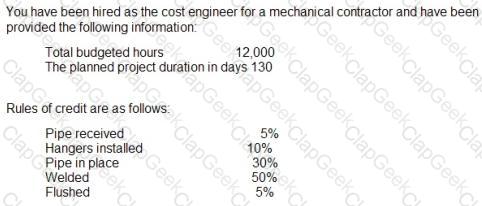

The following question requires your selection of CCC/CCE Scenario 2 (2.3.50.1.2) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

9,375 hours have been expended to date. Planned completion at this time is 75%. The project is determined to be 66% complete. What is the current cost performance index (CPI)?

A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of the design contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

The following question requires your selection of CCC/CCE Scenario 26 (2.5.50.1.2) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

What information is needed to develop a Class 2 definitive estimate?

The following question requires your selection of CCC/CCE Scenario 28 (3.7.50.1.7) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

Given a unit price contract between the owner and contractor, each assumes the following:

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

The following question requires your selection of CCC/CCE Scenario 17 (4.2.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

All of the following are included in "income tax" calculations except:

_____________is defined as the budget for the cost (work) account times the percent complete for that account.

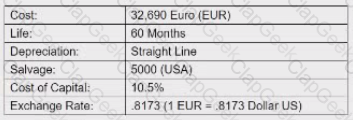

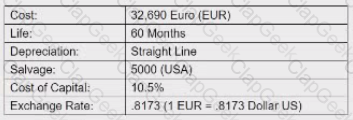

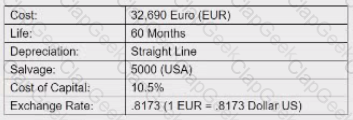

An American company plans to acquire a new press machine from a Dutch manufacturer under the following conditions. One question remaining to be answered is the expected amount of capital recovery when salvage is accounted for.

The following question requires your selection el Scenario 1.4.150 from the right side of your split screen. using the drop down menu to reference during your response/choice of responses.

Based on your analysis, should the press be purchased?

Which of the lol owing comparisons is commonly used in forensics schedule analysis (FSA)?

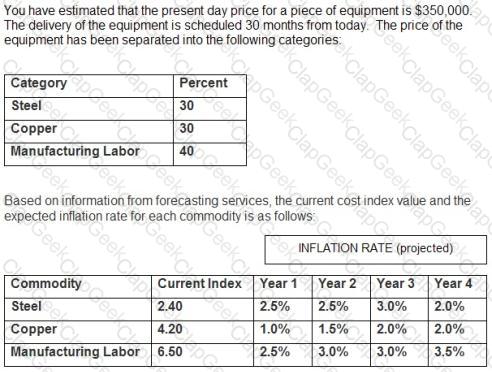

The following question requires your selection of CCC/CCE Scenario 4 (2.7.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

At the end of Year 3, steel prices will have increased by what percentage over today's price? (round to 1 decimal)

A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of the design contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

After an individual's safety needs are met, what needs would the individual be motivated to fulfill next in Maslow’s hierarchy of needs?

SCENARIO: A can manufacturing company requested you to provide data for their decision making The unit prices of the can varies but an average selling price of $0.55 cents and average cost of S45 cents is estimated.

The monthly fixed costs are:

Rant-$1,500

Wages - $4.000

Miscellaneous fixed expenses - $500

If the rent increases by 100% and the unit sales/other costs remain unchanged, the new break even amount is?

If a project is said to be on a "fast track program/' the fast track method is:

What is a basic element of work or a task that must be performed over a given period of time in order to complete a project called?

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and no salvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

Is a rise in the price level of a good or service, or market basket of goods and/or services.

The following question requires your selection of CCC/CCE Scenario 28 (3.7.50.1.7) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

An unbalanced bid methodology can best be used by:

Money is value. Having money when you need it is very important. Money can also be valuable when used wisely by knowing when to spend and when to conserve Also, planning now for future expenses can be a plus to the company rather than a debit.

There are several ways to capitalize money and spending. Basically there is the single payment method that has a compound amount factor and a present worth factor. There is the uniform annual series that has a sinking fund factor, capital recovery factor and also the compound amount factor and present worth factor. At this point, we can assure money is worth 10%.

The following question requires your selection of CCC/CCE Scenario 7 (4.8.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

Five years from now it is required the company have $100,000. How much money should be invested at the end of each year to reach this?

Which of the following is a common technique to approximate the standard deviation?

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

The following question requires your selection of CCC/CCE Scenario 17 (4.2.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

Annual estimated tax would be:

Which of the following is NOT a part of the five (5) phases of value engineering?

When measuring progress using tasks that lack readily definable intermediate milestones and level of effort required is difficult to measure, the best methods to use is:

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and no salvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

All of the following are characteristics of standard normal distribution, except:

A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of the design contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

The recognition of loss of value of a natural resource used in the production process is referred to as:

An owner advertised his villa for sale. An investor worked out an estimate on the basis mat the villa could be rented out for $1000 per month. Maintenance charges and other taxes are estimated to be $1,500 per year. The tenant has to pay all utility charges. The investor thinks that he can sell this villa for S100.000 alter 6 years. Assuming that the minimum acceptable rate of return is 12%. answer the following question.

The villa could be recommended for purchase at all of the below-mentioned prices except:

After collecting the control information on a light rail project within an original budget of 200.000 work hours, the construction contractor is ready for their monthly progress meeting with the client.

A total of 100.000 work hours have boon scheduled to date. with 105.000 work hours earned, and 110.000 work hours paid. The stated progress by the contractor Is 60%.

What is a method for figuring estimate at completion (EAC)?

An American company plans to acquire a new press machine from a Dutch manufacturer under the following conditions. One question remaining to be answered is the expected amount of capital recovery when salvage is accounted for.

The following question requites your selection of Scenario 1.4.150 from the tight side of your split screen. using the drop down menu, to reference during your response/choice o' responses

The present worth interest factor for this purchase in the fifth year would be:

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and no salvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

Which of the following statements of the measures of central tendency is correct?

Which of the following is a disadvantage to using target contract as a method of contracting?

The following question requires your selection of Scenario 1.4.150 from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

Annual depreciation (in USS) would be calculated as follows for a capital recovery with salvage analysis:

A concrete slab measuring 10 feet wide by 13.5 feet long by 6 inches deep is to be installed. How many cubic yards of concrete will be required?

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

Which of the following is considered a measure of profitability?

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and nosalvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

Which numerical method of describing quantitative data is best suited in targeted marketing?

The following question requires your selection of CCC/CCE Scenario 2 (2.3.50.1.2) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

The entire pipe has been received, hangers have been installed, and all pipes are in place. None has been welded or flushed. What percent complete is this project?

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

If $50 was invested at 6.0% on January 1, year 1, what would be the value of year-end withdrawals made in equal amounts each year for 10 years and leaving nothing in the fund after the tenth withdrawal?

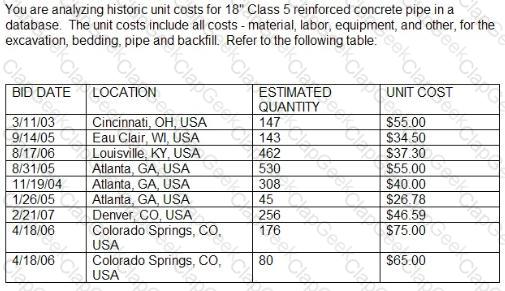

The following question requires your selection of CCC/CCE Scenario 6 (2.7.50.1.3) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

What is the range of estimated quantities?

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and no salvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

Taxes due at the end of year five (5) would be:

refers to the process of calculating and reporting the non-monetary functions of the strategic asset portfolio.

____________ is defined as covering work whose component activities are less defined and whose interrelationships are conditional.

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

The following question requires your selection of CCC/CCE Scenario 17 (4.2.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

Depreciation (in the United States) is calculated in accordance with which of the following?

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

If you buy a lot for $3,000 and sell it for $6,000 at the end of 8 years, what is your annual rate of return?

Money is value. Having money when you need it is very important. Money can also be valuable when used wisely by knowing when to spend and when to conserve. Also, planning now for future expenses can be a plus to the company rather than a debit.

There are several ways to capitalize money and spending. Basically there is the single payment method that has a compound amount factor and a present worth factor. There is the uniform annual series that has a sinking fund factor, capital recovery factor and also the compound amount factor and present worth factor. At this point, we can assume money is worth 10%.

The following question requires your selection of CCC/CCE Scenario 7 (4.8.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

If $10,000 is invested now at 10% compounded annually, what will the investments be worth 10 years from now?

The following question requires your selection of CCC/CCE Scenario 28 (3.7.50.1.7) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

An unbalanced bid methodology can best be used by:

After collecting the control information on a light rail project within an original budget of 200.000 work hours, the construction contractor is ready for their monthly progress meeting with the client.

A total of 100.000 work hours have boon scheduled to date. with 105.000 work hours earned, and 110.000 work hours paid. The stated progress by the contractor is 60%.

How does the project stand?

An American company plans to acquire a new press machine from a Dutch manufacturer under the following conditions. One question remaining to be answered is the expected amount of capital recovery when salvage is accounted for.

The following question requires your selection of Scenario 1.4.150 from the right side of your split screen. using the drop down menu, to reference during your response/choice of responses.

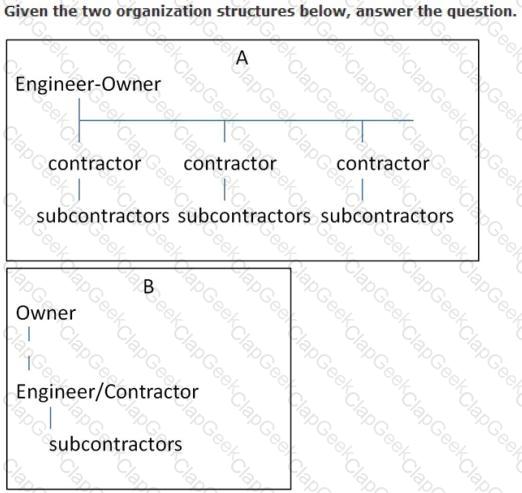

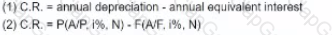

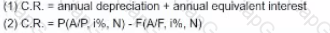

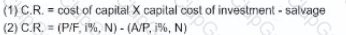

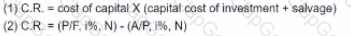

Using normally accepted engineering economic practices, what are the two expected methods that should be used to determine the capital recovery costs for the new press?

A)

B)

C)

D)

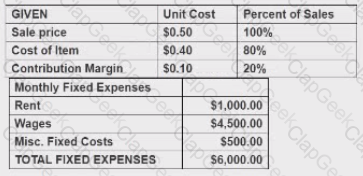

As the leas cost engineer for the XYZ Services Company, you have been requested to provide pertinent for an equipment rental decision. The unit price of the food stuffs varies, but an average unit selling process has been determined to be $0.50 cents and the average unit acquisition cost is $0.40 cents.

The following revenue and expense relationships are predicted:

If XYZ considers S550 per month the minimum acceptable net income, the number of units that will have to be sold is:

Money is value Having money when you need it is very important Money can also be valuable when used wisely by knowing when to spend and when to conserve. Also. planning now for future expenses can be a plus to the company rather than a debit. There are several ways to capitalize money and spending. Basically, there is the single payment mothed that has a compound amount factor and a present worth factor. There is the uniform annual series that has a sinking fund factor, capita1 recovery factor and also the compound amount factor and present worth factor. At this point, we can assume money is worth 10%.

Which of the following is not one of the requirements to form a contract?

Listening to what is being said by all members of a group or audience and then summarizing or interpreting is called______________.

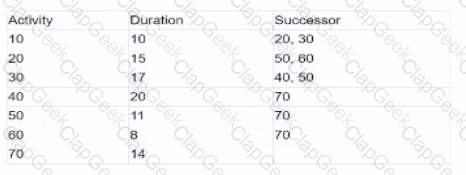

Develop a CPM method considering the below tasks and logical relationships. Use this information to answer the related questions.

What is the late finish date of activity 50?

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

Which of the following would NOT be considered part of a project cost and schedule forecast?

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

The following question requires your selection of CCC/CCE Scenario 17 (4.2.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

What is the 25 year after tax present worth of this project?