What do Guaranteed Income Supplement (GIS) and Allowance for the Survivor have in common?

During the calendar year, Firmansyah received a $1,800 eligible dividend from a large Canadian bank and a $US dollar (USD) dividend of $882.02 from a foreign-based corporation. The USD/CAD exchange rates is 1.3605.

Firmansyah's federal marginal tax bracket is 29%. The enhanced dividend gross-up rate is 38% and the federal dividend tax credit rate for eligible dividends is 15%.

What federal tax liability will be result from his investment income?

Sarah and Kyle are a married couple. They are both 34 years of age and work as teachers. Their combined annual income is $130,000. They are able to save $800 each month. They own a home worth

$340,000 with a $120,000 mortgage. Since they work for the same employer, they have the same defined benefit pension plan. Other than a tax-free savings account (TFSA) in Kyle's name with $5,000, they do not have any other assets.

They are avid sailors and want to save towards a purchase of a sailboat. For the type of sailboat they want, they estimate it should cost around $65,000. They want you to recommend an investment for their monthly savings to help them achieve their goal faster.

What question should you ask them next?

Exchange traded funds (ETFs) that track an index and index mutual funds have many similarities. However, what is a major difference between these two products?

Your employer has a contributory group RRSP under which he matches employee contributions, up to a maximum of 5% of salary.

Which of the following statements about a group registered retirement savings plan (RRSP) is CORRECT?

Charlotte has received proceeds from a deceased family member’s estate. Charlotte decides to visit Malik, who’s a Dealing Representative at her bank. She tells Malik, she does not know much about trading ETFs, but she wants to invest in ETFs. Charlotte says she feels fortunate to have this money and that she’s not worried about losing it because she never planned on having any of it.

What element of the Know Your Client (KYC) information has Malik been able to learn?

Lior is considering an investment that gains exposure to companies that trade on the Toronto Stock Exchange (TSX). He is not sure what the differences are between a Canadian equity fund and a Canadian dividend fund.

What would you tell him?

Which statement CORRECTLY describes index mutual funds and traditional exchange-traded funds (ETFs)?

Which of the following formulas correctly shows how taxable income is calculated?

Patrick is a portfolio manager for the HyperTally Growth Fund. It has generated an annualized rate of return of 10% this past year. However, with the anticipation of very high inflation to soon occur, there is also an expectation of higher interest rates. Patrick is concerned about the future returns of existing stocks within the fund. What may Patrick do to protect against the market value of the fund dropping?

Which of the following statements about your mutual fund registration is CORRECT?

Which statement regarding the underwriting process and over-the-counter (OTC) markets is CORRECT?

Ken is a member of his employer’s Defined Benefit Pension Plan (DBPP). Which of the following statements about Ken’s plan is CORRECT?

Derek submits an order to sell 300 units of the Evergreen Canadian Mortgage Fund at 8:00 p.m. EST on Friday, January 6. His proceeds will be based on the net asset value per unit (NAVPU) for which day (assume no holidays)?

What type of shares offer its shareholders the opportunity to receive additional dividends if the company’s profit exceeds a stated level?

Over the course of a couple of weeks and several appointments, Harold was finally able to provide an investment solution for his new client, Felicia. It was a lump sum investment where they plan to see her

money grow for the next 5 years.

With regards to Know Your Client (KYC) requirements, what are Harold's responsibilities moving forward?

Lucas wants to participate in the Lifelong Learning Program (LLP). He currently has $10,000 in his registered retirement savings plan (RRSP) for this purpose. He plans to make his maximum permitted

withdrawal of $10,000 under the LLP in two months. Based on this information, what would be his investment objective for the $10,000 currently sitting in his RRSP?

Lucas is 60 years old and continues to work. He presently is a plan holder of a registered retirement savings plan (RRSP). He is considering changing his RRSP to a registered retirement income fund (RRIF).

Which of the following statements is CORRECT?

Eleanora receives a $500 eligible Canadian dividend from her mutual fund. Her federal marginal tax rate for the year is 29%. Assuming the enhanced gross-up of 38% and a federal dividend tax credit of 15.02%, how much federal tax will she pay on her dividend?

Your client, Helen, just received her non-registered account statement which states that one of her mutual funds made an interest income distribution during the year. She asks you how she will be taxed on the distribution. What do you tell Helen?

Jasmine received an inheritance from her grandmother of $10,000. She wants to invest her money wisely. She has seen in the news that a particular energy company is doing very well and has good prospects. She has also seen how volatile its share price has been in the last year. She knows the risks of the resource sector and wants to invest but is not comfortable with so much volatility. Which of the following mutual fund benefits would address her concern?

Xerxes, 45 years old, is a successful architect, having an annual income of $185,000. He has around $10,000 in his non-registered account, which he is looking to invest in a tax-efficient manner.

From the following options, which would be the most tax-efficient?

Janine will celebrate her 71st birthday this year. She currently has a lot of money in a personal registered retirement savings plan (RRSP) and knows there are rules about what she can do with those funds. Which of the following is TRUE?

Nelson is a Dealing Representative with True Wealth Advisors Inc., a mutual fund dealer. Nelson follows proper procedures related to his firm’s Relationship Disclosure Information (RDI). Which of the following CORRECTLY describes how Nelson is permitted to evidence that he satisfied his RDI obligation?

Wilma has always used the services of a tax preparation firm to file her taxes but is skeptical that she has really benefitted. This year she plans to file her own taxes for the first time.

What would be useful for her to know?

Gregory is a conservative investor who wants to hold a portfolio of equity securities that would fall less than the overall market in a downturn.

Which of the following portfolios would you advise Gregory to invest in?

What type of mutual fund can invest in specified derivatives and forward contracts for grains, meats, metals, energy products, and coffee?

One of your clients, Rakesh, had a portfolio composed of 60% ABC Equity Fund and 40% ABC Bond Fund. Since equities were performing much better than fixed income, he had increased his holdings in ABC Equity Fund to 70% and had reduced his holding in ABC Bond Fund to 30% of his portfolio.

After benefitting the growth in his ABC Equity Fund for over 2 years, Rakesh is uncomfortable with this heavy exposure to equity funds and decides to rebalance his portfolio back to 60% of ABC Equity Fund and 40% of ABC Bond Fund.

He instructs you to switch 10% of the portfolio from the ABC Equity Fund to the ABC Bond Fund.

Which of the following statements is CORRECT?

Darryl has a diversified investment portfolio of mutual funds in a non-registered account with Investwell Mutual Funds, a mutual fund dealer. Darryl’s diversified portfolio is composed of 3 mutual funds. Each mutual fund is currently worth about $100,000. The ABC Canadian Equity Fund has a total return of 6%, the DEF Bond Fund has a total return of 8% and GHI Global Equity Fund has a total return of 10%. Darryl wants to make an in-kind contribution to his registered retirement savings plan (RRSP) account. He has unused RRSP contribution room of $60,000.

From a tax-efficient viewpoint, which funds contribute in-kind to his RRSP account?

Winter is a Dealing Representative with Top Tier Investing, a mutual fund dealer and member of the Mutual Fund Dealers Association of Canada (MFDA). Which of the following statements about Winter's

suitability obligation is CORRECT?

Winter is required to make a suitability determination every time:

i) she makes a recommendation to a client

ii) a client's investment returns decline.

iii) she opens a new client account

iv) the markets fluctuate.

One of your clients, Fernando, is approaching 71 years of age and has a few questions regarding life income funds (LIFs).

Which of the following statements about LIFs is TRUE?

Which of the following money market securities have the highest degree of risk for the investor?

Which of the following is included when calculating a country's gross domestic product (GDP)?

Thomas, a resident of Ontario, is a full-time university student. He does food delivery to supplement his income. During the school year, he works on weekends and works full-time during his summer break.

Thomas' pensionable earnings were $16,000 for the year. How much must Thomas contribute to CPP when CPP contribution rate is 5.95%?

Which of the following statements about registered education savings plans (RESPs) is CORRECT?

Which of the following statements is TRUE about the movement of business cycles in the Canadian economy?

Quintin has been a Dealing Representative for Global Maximum Financial for 5 years. Today, he opened an account for his new client, Reginald. In addition to opening a new account, Reginald agreed to

accept Quintin's investment recommendation and placed a purchase order to buy units of the Global Maximum Value Equity fund.

Quintin informed his Branch Manager Lupita about this new account on the same day the purchase order was received. Lupita told Quintin that she would complete her review of the New Client Application

Form (NCAF) by no later than tomorrow.

Which statement regarding this new account opening is CORRECT?

Frederic recently sold his units in a US dollar (USD) denominated mutual fund. He wants to convert the proceeds back to Canadian dollars (CAD). If he received proceeds of $1,200 USD from the sale and the exchange rate is $1 CAD for $0.99 USD, how much will Frederic receive in Canadian dollars?

With respect to the tax treatment of dividends received from a taxable Canadian corporation, which of the following statements is CORRECT?

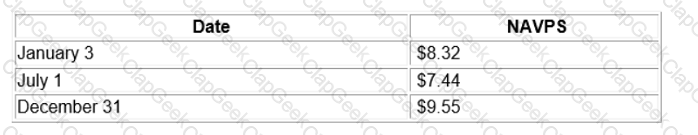

On January 3, John invests $500 in the Blue Sky U.S. Equity Fund. On July 1 of the same year, he invests another $500 into the same mutual fund. Information about the net asset value per unit (NAVPU) at the time of each transaction is provided below. Given this information, what will be the value of John's investment on December 31 of this year (please ignore transaction costs and distributions)?

Sonya meets with her client Elijah to review different investment approaches that could be offered to help him reach his financial goals. Part of that discussion included Sonya mentioning factors such as

inflation, interest rates, and rates of return. Which stage of the Strategic Investment Planning (SIP) process does this describe?

Maureen is 65 years old and will be retiring soon. She has a modest portfolio of mutual funds that focus on growth. As she approaches retirement, Maureen wants to switch to investments that provide steady income with low to medium risk.

Given Maureen’s wishes, which of the following mutual funds would be suitable for her?

Catarina is a Dealing Representative for Ethical Financial which represents 20 different mutual fund families. Darlene is a fund manager from one of those mutual fund families and wants to send a gift card to Catarina as a symbol of appreciation. Ethical Financial's policies and procedures manual (PPM) require that Catarina decline the gift.

What method of addressing conflict of interest is being used by Ethical Financial?

Ai Fen has recently become registered to sell mutual funds with Acadian Eastern Financial, a mutual fund dealer. Ai Fen determined that with her background of being a Chartered Financial Analyst, she can help people understand the nature of investing more easily than others in her field.

Which registration category will need to be prominently noted on Ai Fen’s business card to comply with the “holding out rule”?