XYZ Company is considering selling treasury stock but is concerned about the amount of capital it will raise given the current high volatility of the stock market. What is the BEST strategy a firm can employ to reduce its uncertainty?

Which of the following are basic security issues to be considered in evaluating a treasury management system?

I. Data recovery

II. Anti-virus protection

III. Database access controls

IV. Data integration

Financing decisions in a budget are used to construct all of the following pro forma financial statement components EXCEPT:

Company XYZ is now required to make electronic payments by its suppliers. To prevent an increase in costs, the company shoulD.

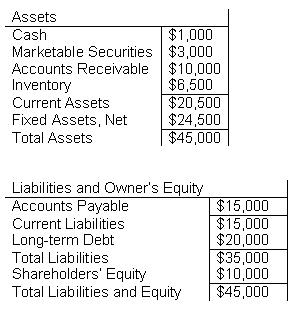

The following information about a company is at the end of its fiscal year.

The before-tax cost of long-term debt is 10% and the cost of equity is 12%. The marginal tax rate is 35%. The company's current ratio is:

A company’s capital structure includes $800,000,000 in total capital, of which $200,000,000 comes from debt. The firm’s after-tax cost of debt is 6%, and its cost of equity is 12%. The marginal tax rate is currently 40%. What is the company’s weighted average cost of capital?

One example of increased use of electronic payments for retail businesses to convert customer checks to cash at the counter more quickly is:

A small for-profit, start-up company is designing a retirement plan with the goal of minimizing costs and operating income volatility while providing a qualified retirement savings vehicle. Which of the following would be the BEST choice?

After several internal discussions about treasury management systems (TMSes), ABC Company has determined that it has no need for customization but that it does want a backup for high priority capabilities. The company wants to reduce its IT costs and resources but still have IT support with in-depth knowledge of the solutions available. These parameters will MOST LIKELY result in what kind of TMS?

Which of the following options would be BEST suited for a firm that wishes to pay no premium?

Company XYZ is conservative when investing in their short-term portfolio. XYZ is looking to add the following money market instruments in their own country: a reverse re-purchase agreement, a floating-rate note, and a negotiable certificate of deposit. What types of investment risks are associated with these instruments?

Simplifying upgrades and system restoration, access from multiple remote locations, and interfacing with multiple applications are all reasons to:

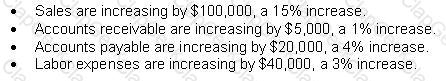

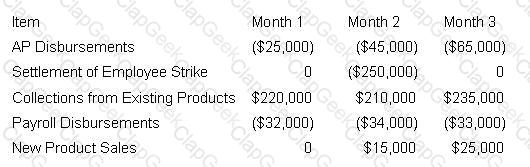

A company is experiencing the following long-term trend on a month-over-month basis:

With all other income, expenses, long-term assets and liabilities remaining stable, this trend would MOST LIKELY prompt what action by the company?

A retail brokerage firm is MOST like which one of the following types of financial institutions?

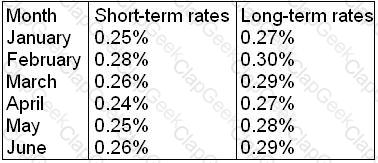

A company has decided to manage its short-term investment portfolio in-house. It is looking for enhanced capital gains as well as the ability to sell the instruments on the secondary market at a premium. The investment manager has forecasted the interest rates shown below:

Which investment strategy should be employed by the company?

The treasury manager of an auto-parts manufacturer has noticed that checks were sent to a foreign individual not on the approved vendor list. The payables manager has explained the payments but did not provide an invoice. The treasury manager did no further research and is later disciplined for:

What is the premium (price) for an oil contract, if the following conditions are present?

LIBOR rate of 5%

Out of the money cost of $3

Strike price is $4

In the money price of $1

Speculative premium of $2

When company profits are high, what is the MOST LIKELY way management will prefer to finance growth?

EML Inc., which has $600 million in outstanding debt, is preparing to issue commercial paper in excess of $100 million within the next six months. The new assistant treasurer has recently spent time getting to know the issuing and paying agent, the rating agency analyst, and the legal counsel, and has been following the financial markets. What is this is an example of?

The controller is developing a financial plan that includes an operating budget and a financial budget. Which of the following statements is true?

The fixed costs to manufacture widgets are estimated to be $54,000. The benefit (sales) of a widget is estimated to be $6.78 per unit, and the variable costs are estimated at $4.48 per unit. What is the estimated break-even point in units for the manufacture of widgets (rounded to the nearest unit)?

Companies that seek out other companies that have successfully redesigned their operations are engaging in a process called:

An art history museum has recently finished renovating its new location. Before the move, the treasurer considers purchasing additional insurance to protect the art during transit. What form of additional insurance should the treasurer choose?

An analyst is performing a lease versus buy analysis on a corporate jet. In the evaluation, a cost is relevant if it is:

The risk that one financial institution’s failure could lead to the failure of other financial institutions is known as:

A cash manager wants to convert wire payments to ACH. Which of the following would NOT be a good application for ACH?

XYZ Company's cash manager is evaluating cash concentration transfer options. The company has an 8% cost of funds and $50,000 in average daily field cash receipts. The wire transfer results in the transfer of funds one day faster. Which of the following options correctly ranks the transfer choices from most cost-effective to least cost-effective?

1. Electronic depository transfer costing $1.00

2. Electronic depository transfer costing $2.50

3. Wire transfer costing $8.00

4. Wire transfer costing $15.00

Which of the following trade payment methods virtually eliminates the seller's credit risk?

ABC Company is a national retail company and uses XYZ Bank for its collections and payroll services. XYZ has recently experienced financial problems; what is the greatest risk to ABC Company?

From a buyer’s perspective, which of the following types of float would be eliminated if checks were replaced by electronic payment methods?

Company ABC has a concentrated investor base consisting primarily of large institutional shareholders. It would like to increase its number of smaller shareholders using the most cost effective method of raising capital available. What should Company ABC do to accomplish this goal?

Which of the following services allows a bank to match checks presented for payment against company check issuance data?

Which of the following types of risk would an investor who does NOT receive payments on a security under the original terms be subject to?

Company ABC needs external capital to finance a new product line. Its operating leverage is high, and its revolving credit agreement contains a ratings trigger. What will Company ABC MOST LIKELY do to finance its new product line?

A major publicly owned U.S. airline announces that it can no longer meet its pension obligations. Which organization will assume control of the airline’s pension plan?

Company XYZ is not sure which direction interest rates are headed. Which of the following would be MOST suitable?

In evaluating alternative capital investments, a company should consider qualitative factors such as:

A company is starting a project to redesign its cash management information systems. What would be an important tool in this effort?

A company is evaluating a project. What is the appropriate discount rate that it should use if its marginal tax rate is 34%, its capital structure is 40% common equity, and 60% debt. Its cost of equity is 10%, and its average cost of debt is 4%?

Which of the following statements are true about collected balances?

I. They can be lower than ledger balances.

II. They are influenced by the bank's availability schedule.

III. They exclude negative account balances.

IV. They may generate an earnings credit.

Which of the following types of payment transactions requires the authorization of both the initiating and the receiving party?

A real estate development company has excess cash that it would like to invest in one of its properties:

Property A has shown an ROI of 40%, a residual income of $25,675, and an EVA of $32,678.

Property B has shown an ROI of 45%, a residual income of $27,635, and an EVA of $29,523.

Property C has shown an ROI of 55%, a residual income of $22,658, and an EVA of $30,678.

Property D has shown an ROI of 52%, a residual income of $19,675, and an EVA of $31,523.

In which property should the company invest?

A company transmits a payment file of ACH and Fedwire vendor payments to its financial institution to execute. Which article of the Uniform Commercial Code governs these payments?

An analyst for a landscaping company wants to adjust her cash-flow forecast to account for the seasonality of outflows. How can this be accomplished?

What is the PRIMARY issue that management needs to consider when determining capital structure?

An arrangement in which a borrower makes periodic payments to a separate custodial account that is used to repay debt is known as a:

The right of stockholders to purchase, on a pro-rata basis, any new shares issued by the company is referred to as:

A public company’s risk profile is currently in balance. The management’s mission statement is to minimize stock devaluation. However, it is forecasting a need for working capital in the short term. Which of the following solutions would BEST assist management in accomplishing its mission?

A company has multiple subsidiaries around the world and is looking to reduce the foreign exchange exposure and risk for each of its subsidiaries. At the same time, it would like to take advantage of the leading and lagging of payments within those countries and improve the export trade financing and collection. What is the solution for this company?

The assistant treasurer for ABC Inc. has been transferred to the headquarters in another country. While conducting a treasury review, the assistant treasurer noticed that a single associate was responsible for maintaining the company's complicated international transfer pricing schedules on a series of inter-linked computer spreadsheets. These spreadsheets were saved on the associate's computer versus the company's mainframe. The associate did not have a backup cross-trained in the function. Which critical types of risk management require the assistant treasurer's immediate attention?

The stock of a manufacturing company is priced so that its expected rate of return is below its required rate, as calculated by the Capital Asset Pricing Model (CAPM). Which of the following will occur in an efficient capital market?

The Treasury Manager is forecasting sales based on historical data. It was observed that sales decreased sharply in December last year, normally a high sales volume period. Further investigation indicated that a severe winter storm was experienced across the Southeastern United States. How should this event be classified in the forecast when considering the sales trends?

ABC Company offers a discount of 2/10, net 30 to its customers. ABC factored its accounts receivables with an outside vendor, under a “with recourse” arrangement. What impact might this have on the company?

A company receives a $5,000 invoice with terms of 1/15, net 45. What is the annualized cost of not taking the 1% discount on day 15 and instead paying the invoice on day 45?

Because of the growing demand in China for oil, a transportation company decides to assume a long position on oil in hopes of generating short-term investment income. Which of the following describes the firm’s strategy?

The treasurer at a U.S.-based manufacturing plant is developing a cash flow forecast for the next four weeks. The treasurer has set a minimum cash balance target for the plant of $75,000 and the cash position in the beginning of week 1 is $28,000. Using the cash receipts and disbursements projections provided in the data set, what is the plant's net investable balance at the end of week 4?

The Fed can reduce the money supply by doing which of the following?

1. Increasing reserve requirements

2. Purchasing government securities

3. Increasing legal lending limits

4. Selling government securities

A corporation is considering utilizing ACH transactions for its large value transfers, as opposed to wire transfers. Which of the following would MOST LIKELY deter the corporation from implementing this change?

XYZ Incorporated, located in Ontario, Canada, is looking to purchase bulldozing equipment for its rental business. ABC Company, which is located in Wyoming, United States, has offered to sell XYZ Inc. $5 million USD worth of equipment payable to ABC Co. over the next six months. If XYZ Inc. purchases this equipment from ABC Co., what is the risk it is taking with this transaction?

A consumer’s personal check written to pay an electronics store charge-account bill is returned three times by the depositor’s bank as NSF. What process is being used?

A variable cost to ABC Company's treasury management system would BEST be identified as:

A retail firm houses large amounts of customer credit card data in its systems. It will have a higher likelihood of which risk type from external forces trying to gain access to that data?

The USA Patriot Act has added significant amounts of overhead to financial transaction processing organizations to prevent money laundering. If an organization does NOT comply with the terms of this act, what external risk is it exposed to?

The custodian of a company's retirement plan provides which of the following services?

In terms of targeting a company’s capital structure, when is it beneficial to assume a high level of financial risk?

Which of the following will MOST LIKELY be affected when a company changes its terms from net 30 to 2/10 net 30?

The U.S. Treasury unexpectedly announces a plan to issue $100 billion of U.S. Treasury bills. Which of the following would MOST LIKELY affect U.S. short-term bond prices and interest rates (all other factors stay constant)?

If a company’s pension plan offered its executives the right to contribute a greater percentage of their salary to the plan than the percentage offered to other employees, it would be at risk of violating the ERISA nondiscrimination rule related to what?

Bank A is to pay Bank B $6,000,000 for 10 transactions that occurred throughout the day. Bank B is to pay Bank C $8,000,000 for 13 transactions that occurred throughout the day. Bank B is to pay Bank A $5,000,000 for 17 transactions that occurred throughout the same day. These banks operate using a gross settlement system. How many transactions will occur between these banks to settle the payments?

ABC Company’s Treasury department outsourced its overnight investment duties to XYZ Money Management. XYZ placed the funds received from ABC into corporate commercial paper, which has recently gone into default after numerous ratings downgrades. The investment policy of ABC Company states that all investments must be in investment grade commercial paper; however, the agreement gives XYZ the ability to make exceptions with the approval of the Treasurer of ABC Company. The Treasurer was never notified of the ratings downgrades. What role or responsibility, if any, was violated with regards to the investment policy?

A U.S. company decides to enter a new geographic market facing some dominant competitors, but projects sales growth of 40% in its first year due to its superior product line. The company decides to only offer electronic payment methods for settlement of its receivables. A year later, the company’s sales volume only increases by 10%, but their average days’ sales outstanding of 32 days is the best in the industry. What should the company have considered in its collection policy objectives?

A U.S. bank is actively trying to establish its operations in an emerging market country, but is not experiencing much success due to differences in the business culture. To gain some market share, an executive of the bank decides to give the son of a local dignitary a highly paid position in the organization. Furthermore, the dignitary is a person of interest on various terror watch lists. Sanctions can be placed on the bank because the executive did NOT establish compliance with which of the following?

In an international banking system, what role is commonly carried out by a large group of clearing banks?

Company X has asked its banking partner for a recommendation on which type of bank account would be best if it has excess funds that are not required for daily cash management. The company determined the excess cash flows by using the short-term cash forecasting distribution method. Company X will require a return on these funds. Which account is recommended?

XYZ Company has a well established commercial paper (CP) program that they use to fund operations. The company is expanding by purchasing a new factory. The CFO is worried about the time and expense needed to issue long-term debt and decides to use the funds they raise in the CP market to pay for the purchase of the factory. This strategy will be successful if:

A recent investigation by a major news network discovered that the management of a company has been actively working to inflate short-term profits in order to increase their bonus payout at the expense of long-term profits. Management actions are an example of an:

The treasury manager has been directed by the CFO to continue sending wire payments to a company that was recently placed on OFAC's list. Is the treasury manager protected if she refuses and reports the activity as illegal?

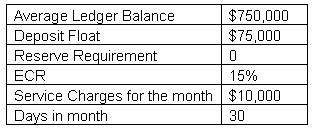

Based on the following information, what is the required collected balance to cover all monthly service charges?

Deposit Float$10,000

Reserve Requirement5%

Earnings Credit Rate15%

Monthly Service Charges$6,000

Days in month30

A corporation has a $500 million revolving line of credit whose interest rate is based on LIBOR. The board authorized the treasurer to initiate a swap transaction which has the company paying a fixed rate of interest rather than a floating rate. The treasurer entered into a swap with a notional value equal to the prior year's average outstanding balance of the revolver. The swap is also initiated for the same period as the revolver's remaining time to maturity. The counterparty for the swap transaction is, however, not a bank participating in the syndicate which had issued the revolver. The corporation's accounting team is now trying to determine the proper income recognition principals to apply to gains or losses on the swap. This is an example of what kind of hedge?

An electronics manufacturer is attempting to protect itself from financial losses due to projected high warranty claims costs for one of its technically complex products. What kind of assessment should the company perform to determine the appropriate external insurance coverage that would protect it from the claims?

West Coast Retail Shop has experienced reduced cash availability in its bank account since a new store manager was hired. The manager is responsible for manually preparing daily bank deposits, which generally include a large number of checks, for processing at a bank branch in the same shopping mall as the store. Which of the following should West Coast Retail Shop implement to improve the available balance in its bank account?

XYZ Company has one inventory supplier, and title to inventory is transferred to the company during the manufacturing process. Which of the following BEST describes XYZ’s relationship with its supplier?

An intern was hired by the Vice President of Accounts Payables to process the electronic payments that come through the bank. The intern is responsible for manually entering payee information into the system at each step of the process. The VP directed the intern to enter the information as fast as possible without mistakes to optimize the number of transactions that could be processed. Instead of manually entering information the VP should have utilized:

Which of the following is a common approach to negotiating EDI payment terms versus paper payment terms?

In most countries other than the United States, which of the following is used to compensate banks for services provided?

A diversified industrial company operates multiple remote manufacturing facilities that manage local supplier relationships. The company draws on a single line of credit for all of its working capital needs. Which of the following types of disbursement systems would BEST meet this company's needs?

A pizza restaurant chain maintains separate accounts at bank branches near each of their 1,067 restaurants to handle the deposit of cash received. Early each morning, the company’s point-of-sale system electronically transmits collection totals from the previous day to its main computer. ACH debits are then initiated to concentrate the funds from the local accounts to the concentration account the following day. Recently, several of the ACH debits have been returned for insufficient funds because deposits weren’t being taken to the bank on a timely basis by the local employees. Without increasing staff at the restaurants, what could Treasury do to prevent this from happening and avoid overdrafts at the local banks?

XYZ Corporation uses ABC Bank for their lending and treasury management. In addition, the bank serves as bond trustee for XYZ Corp. If XYZ Corp. becomes distressed, this relationship could create a conflict of interest for the financial institution. What barrier prevents a financial institution from sharing confidential information between divisions?

A treasury manager has $5 million that is not needed for 6 months. The treasury manager has decided to invest the funds in a liquid instrument, using the current portion of a 5-year AA rated corporate bond that is subject to U.S. Securities and Exchange Commission (SEC) regulations. In what market would the treasury manager purchase this investment?

XYZ Company is a U.S. based company that has just issued some euro-denominated bonds in London. The bonds have a duration of 10 years at a rate of 3.5% with a par value of EUR 50 million. An FX swap contract was created on the date of the issuance in EUR/USD, with a spot rate of 1.2908 and a forward rate of 1.1102. This bond is subject to what type of risk?

What should a company’s senior management consider in their payment policies to eliminate the co-mingling of funds for payables, receivables and foreign exchange transactions?

Company ABC experienced a loss in the past when an employee in the treasury department was able to transfer $1.5 million to a personal account offshore. The company is working with a security agent to prevent this from happening in the future. ABC also accepts a large number of checks as payment. The agent has suggested upgrades to ABC’s payment process. What step should be taken to help mitigate this type of risk in the future?

The School of Cash Management is dealing with a large bank that has been highly rated by Moody’s and S&P. The School has a purchasing card program in place and is not using a highly secure student registration data base. Both the School and the bank have highly automated payment processes. Based on the automation factor, the School should be MOST concerned about which of the following types of fraud exposure?

The Treasurer at ABC Company currently uses an in-house company-processing lockbox center. The Treasurer has asked for an analysis to determine the major advantage of using a traditional check/mail-based lockbox system. ABC receives 287,000 payments per month and hired seven additional staff members to process the payments in-house. Additionally, $389,000 was invested in the equipment used to process the payments and NSF checks have decreased 7% since using the in-house center. The equipment’s current market value is equal to its book value. What major advantage should the analysis indicate?

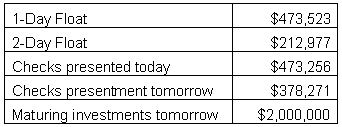

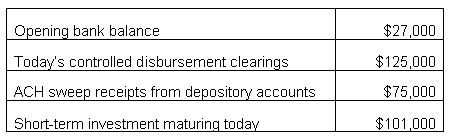

XYZ Corporation’s current ledger balance of the controlled disbursement account is $1,286,500. Based on the information in the table,

what will the corporation's available balance be at the end of today?

The Treasury Manager of a chain of department stores wants to develop a medium-term forecast. Management plans to open two new stores, and anticipates same-store sales to increase by 15%. Which of the following items can be predicted with the highest degree of certainty?

XYZ Company has decided to purchase a close competitor. This acquisition would make XYZ Company the 4th largest in its industry allowing it better purchasing power and greater distribution channels. After completing the M&A analysis, it is determined that the combined companies would produce a 40% increase in revenue, reduce manufacturing costs by 30%, but would increase current liabilities by 27%. Which of the following would keep the acquisition from happening?

Senior management at ABC Company plans to make a large capital expenditure to bolster its infrastructure exactly one year from now. Their primary concern is to preserve the current capital position until the expected cash outlay. The majority of the cash at ABC Company is held in treasury notes, but management would like to also invest some of the money into corporate bonds and money market funds. Which investment objective BEST suits the needs of ABC Company?

The Treasurer at Worldwide Industries is concerned that its retail lockbox provider, Bank A, is not PCI DSS-compliant. Bank A processes 500,000 checks per month for Worldwide Industries. Worldwide Industries uses a third-party provider, Pay Point, for their credit card payments and funds are wired daily to Worldwide’s depository account at Bank A. What should the Treasurer do?

Company A has decided to purchase $3,000,000 of real estate from Company B. Company A will make the payment in 3 parts. The electronic payments will be sent from Bank A to Bank B. On Day 1 Company A will send a $400,000 check as a deposit, which is deductible from the balance. The check is expected to clear in 4 days. On Day 2, two payments are initiated, one wire transfer for $2,000,000 and an ACH for $600,000 to complete the balance. On Day 2 what percentage of the payment to Company B is NOT final?

RAL Industries is a manufacturing company that currently has locations in the United States and Latin America and has just completed an acquisition of a company located in Europe. As a result of the acquisition, they have a large number of financial service providers. In an effort to reduce the number of providers and services used globally, RAL has decided to develop a formal selection process to consolidate its many global banking services. In order to reduce the amount of time the selection process takes, determine which services providers can offer, and the number of providers involved in the process, what should RAL Industries issue?

When a buyer receives goods, but payment is not due to the supplier until some later date, this is defined as:

Company XYZ is aggressively expanding globally. It is evaluating four markets: Latin America, Europe, Asia and Middle East.

Latin AmericA. Risk adjusted discount ratE. 15%, Payback period=7 years, IRR=15%

EuropE. Risk adjusted discount ratE. 8%, NPV=$20M

Middle East: Risk adjusted discount ratE. 11%, IRR=12%, NPV=$5M

AsiA. WACC. 9%, Payback=2 yrs, IRR=8%

Based on the information, which two markets will company XYZ MOST LIKELY pursue?

Based on the following information, how much money will XYZ Company owe the bank for monthly service charges after the earnings credit is applied?

Average Ledger Balance $500,000

Deposit Float$10,000

Reserve Requirement10%

Earnings Credit Rate5%

Monthly Service Charges$5,000

Days in month30

A U.S. company wants to increase its cash turnover rate. It is finding that customers are not taking the offered discount terms of 3/15, net 35. What action might the company take in order to achieve its goal?

CT Check Cashing routinely cashes payroll checks from JD Software. Someone presents a fraudulent check from JD Software to CT Check Cashing. The fraudulent item looks virtually identical to JD Software's regular payroll checks. CT Check Cashing pays the person cashing the check the amount for which it is issued. CT Check Cashing later discovers that the check was fraudulent and wants JD Software to reimburse them for the amount of the check. Which of the following statements is correct?

An accounts receivable manager has been asked to accelerate cash into her company by offering trade discount terms to its customers. Her company's cost of capital is 11%. If she offers terms of 2/10, net 30 on a $50,000 invoice, what is the present value to the company if the customer accepts the discount and pays early?

In terms of capital structure, lease financing normally has the same effect as:

Which of the following business practices does NOT comply with the Uniform Commercial Code?

Which of the following is a KEY objective when instituting a collection and concentration policy?

ABL Corporation is currently receiving a return of 10% on its investments. The bank is offering them an ECR of 15%. In order to get more value for their money ABL Corp. has decided to take advantage of the higher ECR and use funds from its Money Market Accounts to cover bank service charges.

If ABL already has an average ledger balance of $750,000, how much more do they need to deposit on their account to cover all $10,000 of monthly service charges?

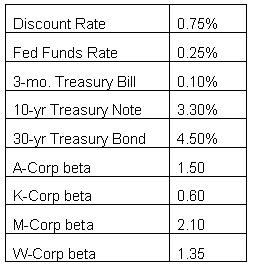

The historic rate of return in the U.S. stock market is 8%. An investment portfolio has a mix of equity investments consisting of 40% A-Corp stock, 30% K-Corp stock, 10% M-Corp stock and 20% W-Corp stock. The investment portfolio manager tends to buy and hold the equity investment position for 3 years on average. To calculate the required rate of return for this investment portfolio,

what rate from the table would be used as the risk-free rate?

Which of the following statements BEST applies when evaluating fees in an RFP for bank services?

Which of the following capital budgeting methods ignores the time value of money?

A company with a relatively poor credit rating borrows most of its funds with short maturities. They may want to change its exposure to interest rates to more correctly reflect the long-term nature of the projects it is funding. Or, they may believe that long-term interest rates are going to rise, causing it to seek protection against the impact of higher interest rates on its balance sheet. Which of the following would be a solution?

Some treasury management systems are capable of initiating investment purchases and loan drawdowns automatically. The automating of these transactions is related to which of the following treasury management functions?

A shareholder right found in many corporate charters is the preemptive right which provides:

A treasury manager expects the price of a commodity to be highly volatile between the time of option purchase and exercise. Which option style would provide the greatest flexibility?

A company has large, ongoing short-term financing requirements with a maximum horizon of 250 days. It has a good credit rating and would like to use the least expensive source of short-term debt to finance its needs. The Treasurer might recommend which of the following?

An evaluated receipts settlement would be MOST commonly used in an environment where:

An Australian firm wishes to borrow CAD 100 million for 10 years to fund an investment in Canada that matures in 12 years. The current exchange rate is AUD/CAD 1.25. The company expects to use the annual net profit of CAD 25-50 million to fund its interest and principal payments. In a rising rate environment, the firm is able to lock in a fixed interest rate of 2.95% from its Australian lender. A Canadian lender is willing to provide a floating rate CAD loan at 235 basis points over the Bank of Canada benchmark lending rate of 0.5%, offering an all-in interest rate cap of 6.00% with a 75 bps premium. What should the company do to manage its foreign exchange exposure?

A company is looking for a way to finance their inventory. What is the BEST funding match?

Banks often control information flow, records and assets, therefore it is critical that banks have:

If a corporation pays 70% of its current earnings to its stockholders in the form of cash dividends, the remaining 30% kept by the company will cause a(n):

Which of the following is true when a company purchases goods using trade credit from suppliers?

A large, nation-wide, retailer of plumbing fixtures is considering implementing ACH technology to improve its accounts receivable processing. Which of the following pre-authorized ACH transactions can the company use for this application?

What is one chief advantage of issuing short-term securities in book-entry form?

A multinational company owns a United Kingdom subsidiary that has total assets equal to £1 million and intercompany loans due to the parent company equal to $1 million. It would like to undertake a balance sheet hedge of the U.K. subsidiary’s GBP liability because it expects a depreciation of the pound. Given these circumstances, which of the following actions would be appropriate?

A U.S. exporter sells goods to a foreign buyer in U.S. dollars and wants to guarantee that payment is made by the buyer. The exporter would MOST LIKELY require a(n):

All of the following bank products and services can simplify the preparation of the daily cash position EXCEPT:

Which of the following is LEAST important when a cash manager determines a company's short-term cash position?

Companies in the U.S. with a nationwide over-the-counter/field bank collection and concentration system often deal with:

Company X, a US based multi-national, is exploring the option of locating a subsidiary in another country where there has been some historical risk of expropriation of local assets of foreign corporations. Therefore, as part of the risk assessment process the company must specifically quantify the:

To acquire an asset without putting debt on the balance sheet, a company should consider which of the following arrangements?

To arrive at today’s projected closing cash position, a cash manager starts with:

When projecting the closing cash position, a cash manager must estimate which of the following?

The CFO of a growing company has decided that it would be prudent to insure the company against potential loss from dishonest acts of employees. The treasurer has been given the responsibility of selecting and negotiating the type and amount of protection required. After analyzing the overall risk to the company, the treasurer decides that the greatest exposure to this type of risk is within the cash management function of the company. The MOST appropriate type of protection would be:

Which of the following is NOT one of the three goals of a disbursement system?

A U.S. bank regularly transmits international payments to European based XYZ Bank. The payments flow through an intermediary bank. Recently regulators audited the intermediary bank and discovered the bank may be unknowingly facilitating illegal activities. What payment method was MOST LIKELY used?

Merchant XYZ has total credit card sales of $20,000 for one day with an average ticket of $200. The merchant’s interchange reimbursement fees are 2% and transactions fees are $0.05. This merchant receives net settlement. Which of the following is the value of the deposit for that day?

I. Banker’s acceptances

II. Commercial paper

III. U.S. Treasury bills

IV. Federal agency securities

Which of the following is the MOST usual ranking, from lowest to highest risk, of the investments listed above?

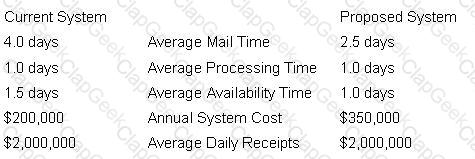

A company is considering expanding to a three-site lockbox system from its current two-site system and has collected the following data:

The average collection float in the current system is:

A utility company is evaluating whether or not it should build a new plant. The process of reviewing the quantitative and qualitative factors are an example of which finance function?

Which of the following industries is MOST LIKELY to use a sophisticated cash concentration system with multiple banks as part of its cash management system?

A trader of ABC Bank executed and audited his own trades. Assigning these two functions to the same person introduced which one of the following risks to the bank?

Which of the following could be considered a weakness of a forecast derived by regression analysis?

The first step in the financial institution and financial services provider (FSP) selection process should be:

Company X has a rating that is below investment grade. The treasurer would prefer to use commercial paper for its short-term financing needs and has a commitment from its bank to provide a standby letter of credit. What costs would be associated with this process?

A large U.S. company is planning to fund its Canadian subsidiary. Currently, the Canadian dollar is trading at CAD 1.25 per U.S. dollar, and the U.S. dollar is expected to depreciate in the near term. To manage this FX exposure, what technique should the company implement?

All of the following factors influence a company's decision to use electronic commerce EXCEPT:

Assuming a marginal tax rate of 36%, the taxable equivalent yield for an investment with a tax-exempt yield of 3% would bE.

Under the standards of corporate governance adopted in 2002, an independent director must:

A seller’s cost of capital is 12%. The average credit sale is $200,000, and the credit terms are 2/10, net 30. What is the present value of receiving full payment on day 30?

Which of the following statements is typically true about a net settlement system?

A company has negotiated a credit facility with the following terms:

$5,000,000 line of credit

$3,000,000 average borrowing

30 basis point commitment fee on the unused portion of the line

Interest rate on advances is 1-month LIBOR plus 4%

1-month LIBOR is currently 2%

What is the annual interest rate on the line of credit?

A subsidiary of a large multinational organization was set up in an Asian country. The controller of the organization wants to determine the functional currency of the subsidiary. Which statement correctly describes what determines the functional currency of the subsidiary?

A U.S. exporter has agreed to export goods to a Canadian buyer with net 30 payment terms due in Canadian dollars. What type of risk is the exporter exposed to?

A company is concerned that investor dissatisfaction could lead to a rapid change in its board membership. To prevent this, which of the following strategies should the company employ?

Transmission of a file of items presented for payment by the payor bank to the issuing company is known as:

A Euro denominated payment can be settled through all of the following EXCEPT:

Consider a firm issuing quarterly dividends to consumers. When the ACH file is generated to the consumer accounts, which SEC code is MOST appropriate to utilize within the payment file?

The owner of XYZ Company just completed an initial public offering. Which of the following is the MOST LIKELY outcome?

What type of encryption program is designed to provide security when used on unsecured networks?

An accounts payable manager has been mandated to accept all trade discount opportunities with an effective cost of discount above 25%. An invoice has been presented and approved for payment with terms of 3/5, net 30 days. What is the difference between the effective cost of discount offered, and the 25% rate set by the company?

The treasurer of XYZ Company reached out to its local banker for a $7MM line of credit. The banker is able to offer the facility for an all-in interest rate of 6% for a service fee of 45 basis points. Additionally, there is a commitment fee of 75 basis points for the unused portion. XYZ uses $5.5MM of the facility in the first year. What is the annual borrowing cost for XYZ (round to two decimal places)?

Which cost benefit analysis technique uses the methodology to find where the present value of each project’s cash inflows equals the present value of each project’s outflows?

What is the correct sequence of the following disbursement float events, from first to last step?

1. Check clears back to drawee bank account.

2. Check is encoded and enters the clearing system.

3. Depositor receives ledger credit.

4. Lockbox bank receives check.

Which of the following activities creates administrative costs associated with a concentration system?

In recent years, there has been a sharp increase in the use of technology for certain financial transactions. Which of the following has increased dramatically over recent years?

Which of the following is an advantage of a decentralized disbursement system?

The PRIMARY objective of the AFP Account Analysis Standard is to help cash managers in which of the following areas?

To increase the money supply, the Federal Reserve would increase which of the following?

Which of the following cash concentration transfers is MOST LIKELY to result in a bank ledger overdraft?

Which of the following are interest-bearing instruments?

I. Certificates of deposit

II. Treasury bills

III. Treasury notes

IV. Banker's acceptances

Which of the following can be used for monitoring accounts receivables?

I. Aging schedule

II. Credit terms

III. Days' sales outstanding

IV. Receivables balance pattern

True statements about the open account method of trade payment include which of the following?

I. A bank guarantees payment.

II. It is the most common type of trade credit.

III. A periodic credit review of each customer is required.

IV. The customer makes equal monthly payments.

The process by which a bank or insurance company guarantees the debt obligation of a borrower is referred to as credit:

When investing in commercial paper, the investor's primary consideration should be which of the following?

Which of the following is responsible for liquidating the assets of failed financial institutions?

The time from the deposit of a check in a bank account until the funds can be used by the payee is known as:

Which of the following are primary objectives of cash forecasting?

I. Managing liquidity

II. Optimizing float

III. Enhancing financial control

IV. Minimizing borrowing costs

Treasury management systems help cash managers do which of the following?

I. Reduce borrowing expenses

II. Initiate transfers

III. Determine cash position

IV. Obtain account balances

A company has average monthly sales of $2,700, of which 5 percent is on a cash basis, with the remaining sold on open account. The company's accounts receivable aging schedule at the end of March is as follows:

What is the company's DSO?

In order to reduce the premiums paid to insurance companies, a company should consider retaining or self insuring for:

Which two of the following are methods for concentrating weekend deposits in a field deposit system?

1. Using a wire transfer for the funds on Monday

2. Anticipating deposits and initiating an ACH on Friday

3. Initiating an ACH cash concentration transaction on Thursday

4. Using a multibank lockbox network

A company has transferred all treasury functions to a new office overseas. When preparing the disaster recovery plan, the treasury manager seeks to identify the mission critical functions and then determine what risks the plan should address. Which of the following risks should be the focus of the Disaster Recovery Plan?

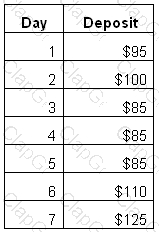

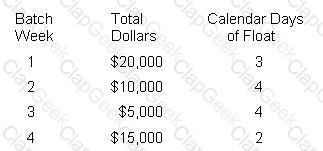

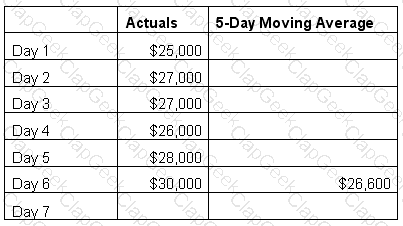

This question is based on the following data describing a company's actual deposits.

If a five-day moving average is used, what was the deposit forecast for day six?

Upon entering into an interest rate swap with a notional principal of $10,000,000, what is the initial amount of money the counterparties must exchange at the beginning of the swap?

A company wants to implement more control over its cash management system. Which aspect of the system is the most susceptible to external fraud?

A company agrees to pay ¥10,000,000 for a shipment from Japan. At the time the purchase order is placed the exchange rate is ¥168/US$. At the time of payment the exchange rate is ¥163/US$. What is the net effect on the dollar cost of the shipment if the transaction has NOT been hedged?

A merchant presents 2 different batches of credit card transactions for processing, each batch has the same dollar value and number of transactions, but the fees are different. Which of the following explains why?

"Fees" in Country Y, which would be considered bribes in the United States, are ingrained in the commercial culture. A U.S. company doing business in Country Y:

An assistant treasurer discovers that the CFO has been allowing other executives to exercise stock options during blackout periods. What will prevent the assistant treasurer from losing his/her job if he/she reports this discovery?

When establishing a retail collection system that accepts consumer debit cards, a company must comply with which Federal Reserve regulation?

XYZ Company is considering different methods of concentrating cash from its subsidiary accounts to its main operating account. It uses short-term borrowings with a rate of 7% to fund daily operations, and the reserve adjusted earnings credit rate on its subsidiary accounts is 1%. A review of its bank fees shows that wires (same day transfer) cost the XYZ Co. $7.00 each while ACH debits (next day transfer) cost $1.25 each. If the primary objective is to minimize costs, what must the transfer amount be (rounded to the nearest whole $) to justify the use of a wire transfer instead of an ACH to concentrate the funds?

A manufacturing company has no liquidity and needs to purchase additional inventory in 60 days. Which of the following would have helped the company plan for this situation?

Company A anticipates the following cash inflows and outflows for the next three months:

If the company's treasurer is preparing a cash-flow projection for Month 2, and he is focusing purely on items that can be projected with a fair degree of certainty, what will the net projection be?

A bank's reserve requirement on demand deposits is 10%, and its earnings credit rate is 6%. If a company uses bank services amounting to $2,600 and has an excess of $550 in earnings credit, what is the average collected balance in the account based on a 30-day month?

Which of the following is an example of using cash forecasting for liquidity management?

A treasurer is evaluating a project that will cost $1,000 but will return cash flows of $225, $225, $300, $750, and $750 in years 1 through 5, respectively. The company’s interest rate on its debt is 10% and its marginal cost of capital is 15%. What is the Net Present Value (NPV) of this project?

The lockbox receipt records for one 30-day month are provided below. The opportunity costs are 10%.

What is the annual cost of float rounded to the nearest dollar?

A company can dispute any check alterations within how many days after the bank statement has been sent?

A company seeking an insured investment would avoid investing surplus cash in a:

Contingency plans often focus on the business supply chain, ensuring that customer service is maintained. The financial supply chain, which is equally critical to the plan, should address:

Which of the following is an example of a qualitative factor used in making credit decisions?

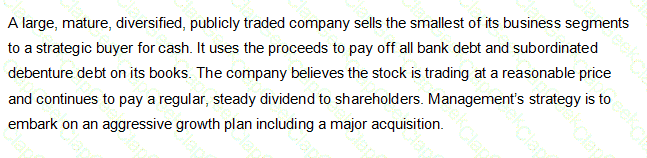

Based on the above information, before making the major acquisition, several large institutional shareholders have asked management to consider all of the following EXCEPT:

On a daily basis, the cash manager is responsible for all of the following EXCEPT:

Which of the following types of payments would NOT be included in cash flow forecasting?

The Cash Manager of XYZ Corporation is trying to determine today’s closing cash position in order to make an investment or borrowing decision. The Cash Manager anticipates wiring $55,000 in tax payments and $63,000 in supplier payments today. Additionally, the Cash Manager is aware that a $15,000 wire was received today into the company’s concentration account from a customer and that XYZ Corp. will have to fund a bond interest payment of $200,000 in three days.

Using this information, as well as the data in the table, what is the closing cash position for XYZ Corporation?

Company XYZ uses exponential smoothing to forecast its daily lockbox receipts. With the help of a statistical computer program, the company has determined that the smoothing constant is 0.35.

Using the data in the table, what is the exponential smoothing forecast for Day 7 (rounded to the nearest whole $)?

A company purchases a machine tool with an expected life of 3 years. Under the accrual accounting method, the equipment would be treated in which of the following ways?

Under an operating lease, possible benefits to the lessee include which of the following?

I. It requires no initial capital outlay.

II. It can be structured as an off-balance-sheet item.

III. It can offer tax advantages.

Which of the following statements is (are) true about non-repetitive wires?

I. They may require additional security steps.

II. They are typically used for cash concentration.

III. They may be used for transactions where dates, parties, and/or amounts may be variable.

XYZ Corporation is presently a short-term borrower and uses a revolving line of credit with an interest rate of 7%. The Treasurer would like to reduce interest expense and increase liquidity without renegotiating the line of credit. Which of the following projects should the Treasurer support in order to achieve this objective as quickly as possible?

A company's investment guidelines typically restrict all of the following EXCEPT:

Which of the following would MOST LIKELY cause a decrease in a company's deposited checks availability?

A United States corporation purchases finished products from a German subsidiary and sells raw materials to the subsidiary several times in one month. To minimize foreign exchange transaction costs, the U.S. corporation's cash manager would MOST LIKELY use:

The role of the depository bank in the check-clearing process is typically which of the following?

An olive oil producer in Macedonia is arranging for shipment of its product to an international distributor. To support this activity, the company arranges for export financing because:

The U.S. government agency that administers and enforces trade sanctions against targeted foreign countries is the:

A firm’s air conditioning unit breaks down unexpectedly and must be replaced immediately. What type of liquidity requirement is this an example of?

U.S.-based manufacturing Company XYZ is looking to deliver finished goods to ABC Company in a developing nation. The credit department wants to ensure collectability and has asked the treasury department for guidance. The desired solution may impact days sales’ outstanding but will have the lowest credit risk to Company XYZ. What will treasury recommend?

Multinational corporations repatriate funds from foreign operations through which of the following?

Improvements to the cash flow timeline from a selling company’s perspective would include:

When a foreign subsidiary pays a dividend to its parent company the transfer of funds may be subject to:

An L/C in favor of a U.S. exporter is issued by a bank in an emerging-market country, and it is confirmed by the exporter’s bank. What risk is reduced for the U.S. exporter?

Which of the following would increase if the Fed were to announce a reduction in reserve requirements?

ABC company has a significant number of customers who are mainly consumers making monthly installment payments. Which one of the following types of lockbox would be the MOST appropriate for ABC to use?

The Sarbanes-Oxley Act of 2002 requires that a public company’s financial statements be certified by the company’s:

In the event of bankruptcy and the subsequent liquidation of issuer's debt, in what order, from first to last, will the following be repaid?

1. Senior secured debt

2. Senior subordinated debt

3. Junior secured debt

4. Junior debentures

Which of the following institutions would be regulated by the Office of the Comptroller of the Currency (OCC)?

Company ABC has recently started to experience a significant reduction in funds availability. Which of the following is MOST LIKELY to reduce funds availability?

A multinational company that uses “notional pooling” for its euro zone subsidiaries will realize which of the following advantages?

At the time of the initial debt contract, the only way debt holders can protect their interests effectively is to establish certain provisions or covenants designed to:

Which of the following are reasons for companies to use controlled disbursement?

I. To obtain timely check presentment information

II. To enhance supplier relationships

III. To increase their available cash

IV. To improve their overall creditworthiness

Which of the following should be considered in the design of a collection system for a supermarket or retail store that does not offer proprietary credit cards?

I. Coin and currency handling

II. Debit card acceptance

III. Retail lockbox

IV. Third-party credit cards

Operational risk is defined as the risk of direct or indirect losses resulting from external events or failure of internal resources. As treasury departments maintain legacy systems that must be integrated into more complex technology, one would expect that:

A company has a high value for its current ratio. What does this suggest in terms of liquidity and risk?

On a company’s financial statements, an increase in accounts receivable is reflected as a(n):

When a company must determine the optimal mix of long-term borrowings versus common equity, it is making which of the following types of corporate financial decisions?

An increase in the availability float on a company's collections would cause a reduction in which of the following?

I. Earnings credit

II. Ledger balance

III. Service charges

IV. Collected balance

Which of the following is a common method for assigning float on a check deposited to a non-US bank account?

The term "collection float" is defined as the delay between the time the payor:

A company that has a nationwide workforce may use which of the following methods for disbursing payroll to minimize the number of bank accounts?

I. Payable through draft

II. Multiple drawee checks

III. ACH credit transfers

A large multinational company recently implemented new processes to automate its treasury operations. If these changes were the direct result of comparing the company's practices with those of other companies, the activities could be considered an example of which of the following?

I. Liquidating

II. Re-engineering

III. Benchmarking

IV. Forecasting

An employee earning $80,000 per year decides to begin contributing to his company’s 401(k) plan effective January 1st. Assuming he is in the 25% tax bracket, contributes 15% of his pay into the plan each month and receives a company match of $0.50 for every dollar he contributes, what is his taxable compensation that year?

XYZ Inc. is a publicly traded company with revenues of $1B and an operating profit of 7.5%. The treasury organization consists of a treasurer and an assistant treasurer. The assistant treasurer is responsible for the creation and approval of all payments. The treasurer is responsible for compilation of the financial statements. Under Section 404 of the Sarbanes-Oxley Act, what should be viewed as a concern?

Which of the following is NOT true for both bankers’ acceptances and trade acceptances?

A company in the market to purchase a treasury management system (TMS) has issued a request for proposal to evaluate various vendors. One of the evaluation factors focuses on the long-term viability of the vendor. The company may have to choose between an untested new vendor with a superior product and an established vendor with an incomplete product suite. This dimension of the RFP is measuring what type of risk?

What document serves as the basic account or service authorization, empowering a representative of a business to enter into agreements for financial services?

Private companies usually go public by making an initial public offering. What is the term for offering subsequent shares in the market?

Which of the following actions would the CFO of a Canadian multinational conglomerate MOST LIKELY take to repatriate profits from its international subsidiaries?

Which of the following would be true for a company with high operating leverage?

DGB Inc.’s CEO and founder retired shortly after the company went public two years ago. DGB Inc. has recently struggled, and the founder has agreed to return as an independent director. What violation, if any, has occurred?

XYZ Inc. has limited cash flow, total liabilities to total assets greater than 52%, and a high WACC. To help meet the goal of lowering their WACC, the company plans to issue several million dollars of private equity to the chairman of the board. If the company proceeds with this plan, the company may:

A company with $50 million in foreign assets decides to increase its foreign debt by $40 million for a debt ratio of 80%. This action will reduce which exposure?

A U.S. company has a secured committed line of credit of $5 million. The company successfully transmitted a $5.5 million wire transfer instruction out to the bank. The bank contacted the company and informed it that the wire transfer would not be processed. What is the MOST LIKELY reason the bank gave the company?

A nationwide retailer has been making EFT payments to its suppliers for several years. It will expand its processes to include consumer payments in its EFT initiative. Which of the following will support this initiative at the point-of-sale?

A corporate compliance officer is drafting an agenda for an ethics training session. Which of the following would NOT be an appropriate item to include?