AB and FG incorporated on 1 January 20X1 in the same country and had similar investment in net assets. Both entities are financed entirely by equity. In the year to 31 December 20X1 both entities generated the same volume of sales.

Which of the following, taken individually, would explain why AB's return on capital employed ratio was lower than that of FG?

On 1 January 20X4 EF grants each of its 125 employees 500 share options on the condition that they remain in employment for 3 years. During the year to 31 December 20X4 10 employees left and It is expected that a further 25 will leave before the end of the vesting period.

The fair value of each share option is $30 on 1 January 20X4 and $45 on 31 December 20X4.

What is the journal entry in respect of these share options in EF's financial statements for the year ended 31 December 20X4?

FG has a weighted average cost of capital of 12% based on its existing:

• level of gearing of 30% (measured as debt/(debt + equity)); and

• business operations.

This would be used as an appropriate discount factor to assess which of the following significant projects?

GH acquired 3,000,000 of the 12,000,000 equity shares of JK. All shares carried equal voting rights and no other single shareholder of JK held more than 10% of the equity shares. GH has the power to participate in the financial and operating policy decisions but not control them.

Based on the information provided above, how would GH's investment in JK be accounted for in its consolidated financial statements?

ST has in issue unquoted 7% debentures which were issued at par and are redeemable in 1 year's time. These debentures cannot be traded. The yield to maturity on these debentures has been calculated at 5%.

Which of the following would explain why the yield to maturity is lower than the coupon?

GG's gearing is currently 50% compared to the industry average of 40% (both measured as debt/equity). GG's debt is all in the form of a single bank loan that is repayable in five years' time. The directors of GG are seeking to raise finance for a new project and they are considering an additional bank loan from the same bank.

Which of the following would prevent the bank from lending the finance for the project in the form of a new bank loan?

On 1 January 20X8 XY, a listed entity, had 10,000,000 ordinary shares in issue each with a par value of 50 cents. On 1 July 20X8 XY raised $6,000,000 by issuing ordinary shares at a price of £1.50 each which was the full market price.

Place the correct figure into the box below to show the number that XY will use as its weighted average number of ordinary shares in the calculation of earnings per share for the year to 31 December 20X8.

Which TWO of the following would be the primary disadvantages of producing the disclosures required in IFRS12 Disclosure of Interests in Other Entities?

YZ issued $100,000 6% convertible bonds at par on 1 January 20X5. The bondholders have the option to convert into equity shares in 3 years' time or redeem at par for cash on the same date.

Interest is paid annually in arrears and bonds issued by similar entities without conversion rights pay interest at 8%.

What is the value of equity to be recognised in YZ's statement of financial position as at 31 December 20X5?

Give your answer to the nearest whole $.

$?

KL sells luxury leather handbags and has 3 stores in exclusive shopping areas. Following years of static revenues and margins, in August 20X6 KL opened a fourth store at a busy airport terminal which is proving to be successful.

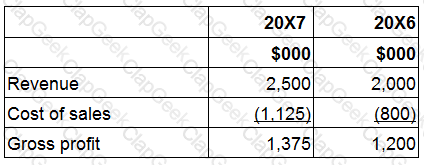

The revenue and gross profit of KL for the years ended 31 March 20X7 and 20X6 are as follows:

Which of the following would be a contributing factor to the movement in the gross profit margin of KL?

UV entered into a five year non-cancellable operating lease for an asset two years ago. Lease payments are settled annually in arrears.

At the year end, UV no longer requires this leased asset as they have decided to discontinue the product line that it was used for.

At this date UV had made two out of the five lease payments.

Which of the following statements about the unavoidable lease payments is true in accordance with IAS 37 Provisions, Contingent Liabilities and Assets?

On 1 January 20X4 JK had 1,500,000 ordinary shares in issue. On 1 September 20X4 JK issued 600,000 ordinary shares at the market value of $2.50 a share. For the financial year ended 31 December 20X4 the statement of profit or loss shows profit before tax of $625,000 and profit after tax of $500,000.

What is the earnings per share for the year ended 31 December 20X4?

When producing the consolidated statement of profit or loss and other comprehensive income, which TWO of the following will be disclosed as attributable to the equity holders of the parent company and the non-controlling interests?

Information from the financial statements of an entity for the year to 31 December 20X5:

The gearing ratio calculated as debt/equity and interest cover are:

HJ is currently in dispute with an employee, who is claiming $400,000 in a legal case against them.

HJ's legal advisors have stated that it is probable that they will lose the case and will have to pay the amount claimed.

Also, HJ are claiming $250,000 from a supplier of defective goods and the legal advisors have stated that it is probable that HJ will be successful in this claim.

What is the correct accounting treatment for these two items in HJ's financial statements?

The tax benefit on a company's asset is £180,000 and the useful life on that asset is five years. The company creates a deferred tax provision to spread this benefit over the asset's useful life.

What entry is needed to reduce this deferred tax provision in the company's year two accounts?

Which of the following statements is true in respect of ST's gross profit margin based on the information given?

Which of the following are limitations of financial statement figures for ratio analysis? Select the ALL that apply.

Taking each statement individually, which of the following explains the movement in the gross profit margin from 20X4 to 20X5 as calculated by the analysts?

LM acquired 15% of the equity share capital of ST on 1 January 20X6 for $18 million. LM acquired a further 50% of the equity share capital of ST for $50 million on 1 January 20X7 when the fair value of ST's net assets was $82 million. The original 15% investment in ST had a fair value of $20 million at 1 January 20X7. The non controlling interest in ST was measured at its fair value of $30 million at the date control in ST was acquired.

Calculate the goodwill arising on the acquisition of ST that LM included in its consolidated financial statements at 31 December 20X7.

Give your answer to the nearest $ million.

$ ? million

LM are just about to pay a dividend of 20 cents a share. Historically, dividends have grown at a rate of 5% each year.

The current share price is $3.05.

The cost of equity using the dividend valuation model is:

Which THREE of the following actions should improve the cash position of an entity?

Which TWO of the following are true in relation to IAS21 The Effects of Changes in Foreign Exchange Rates when consolidating an overseas subsidiary?

HJ is currently in dispute with an employee, who is claiming $400,000 in a legal case against them.

HJ's legal advisors have stated that it is probable that they will lose the case and will have to pay the amount claimed.

Also, HJ are claiming $250,000 from a supplier of defective goods and the legal advisors have stated that it is probable that HJ will be successful in this claim.

What is the correct accounting treatment for these two items in HJ's financial statements?

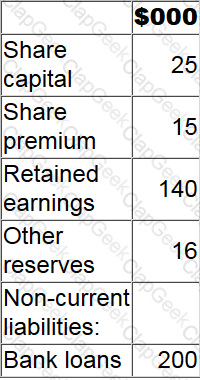

MN had the following profit figures for the year ended 30 November 20X6:

MN's statement of financial position at 30 November 20X6 included the following:

Calculate return on capital employed for MN for the year ended 30 November 20X6.

Give your answer to one decimal place.

? %

The following information is extracted from the financial statements of RS for the year ended 30 June 20X7:

RS has no other liability balances and has no associate investments.

Calculate return on capital employed for RS at 30 June 20X7.

Give your answer to the nearest whole %.

? %

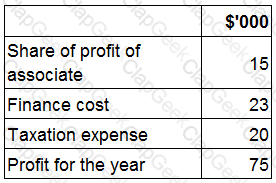

Information from the financial statements of RST for the year ended 30 April 20X9 is as follows:

At 30 April 20X9 the ordinary shares are trading at $4.75.

What is the price earnings (P/E) ratio for RST at 30 April 20X9?

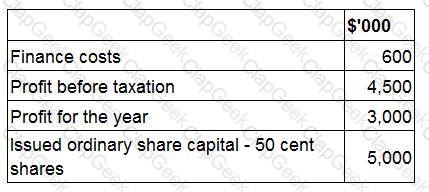

The consolidated statement of profit or loss for VW for the year ended 30 September 20X7 includes the following:

What is VW's interest cover for the year ended 30 September 20X7?

How would KL account for its investment in MN in its consolidated financial statements for the year to 31 December 20X9?

Which TWO of the following are TRUE in respect of preparing a consolidated statement of cash flows where there has been an acquisition of a subsidiary part way through the year?

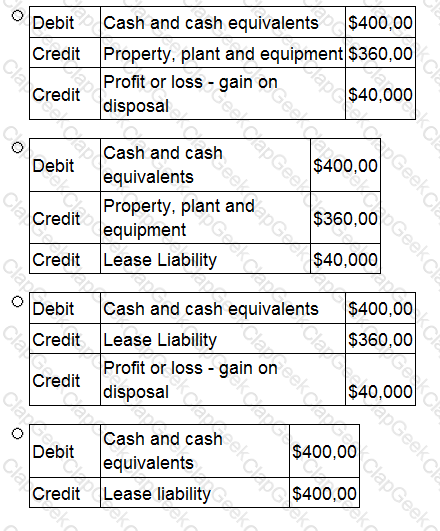

ST has sold its main office property, which had a carrying value of $360,000, to AB, a property management entity.

The property was sold for $400,000 which is equal to its fair value and was immediately leased back under an operating lease agreement.

Which of the following journals will record this transaction?

LM acquired 80% of the equity shares of ST when ST's retained earnings were $50 million. The fair value of the net assets of ST included a contingent liability with a fair value of $100 million at the date of acquisition and a fair value of $40 million at 31 December 20X6. No other fair value adjustments were required at the date of acquisition.

LM and ST had retained earnings of $200 million and $80 million respectively at 31 December 20X6.

The consolidated retained earnings of LM at 31 December 20X6 were:

FGH plans to issue a large number of shares to the public via an IPO.

It is considering either an offer for sale at a fixed price or an offer for sale by tender.

Which of the following would be an advantage to FGH of using the offer for sale by tender compared to the fixed price offer?

Which of the following reduce the usefulness of ratio analysis when comparing entities that operate in the same industry?

Select ALL that apply.

GG's gearing is currently 50% compared to the industry average of 40% (both measured as debt/equity). GG's debt is all in the form of a single bank loan that is repayable in five years' time. The directors of GG are seeking to raise finance for a new project and they are considering an additional bank loan from the same bank.

Which of the following would prevent the bank from lending the finance for the project in the form of a new bank loan?