Reference module: Essentials of always-on outbound

A bank has been running traditional marketing campaigns for many years. One such campaign sends an offer email to qualified customers on day 1. On day 3, it sends a reminder email to customers who haven't responded to the first email. On day 7, it sends a second reminder to customers who haven't responded to the first two emails. If you were to re-implement this requirement using the always-on outbound customer engagement paradigm, how would you approach this scenario?

U+ Bank currently uses Next-Best-Action Designer to manage 1:1 customer engagement in the web channel. The bank would like to promote the same offers in email. Which two additional configurations are needed in Next-Best-Action Designer to promote the offers in email? (Choose Two)

U+ Bank has several eligibility criteria defined using an eligibility strategy. The eligibility strategy uses a scorecard rule to determine the customer credit score. The bank wants to update the scorecard to include customer income in the credit score calculations. How do you implement this change?

Reference module: Leveraging predictive model.

U+, a retail bank, wants to show a retention offer to customers who are likely to leave the bank in the near future based on historical customer interaction data. Which type of model do you use to implement this requirement?

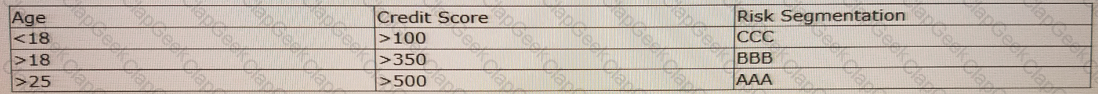

U+ Bank wants to offer credit cards only to customers with a low-risk profile. The customers are divided into various risk segments from AAA to CCC. The risk segmentation rules that the business provides use the Age and the customer Credit Score based on the following table. The bank uses a scorecard model to determine the customer Credit Score.

As a decisioning consultant, how do you implement the business requirement?

A bank wants to present the Rewards Card offer on the top right of the customers’ account page when they log in. Select the placement type of the treatment design.

A strategy designer has created 10 actions in the Sales/Credit Cards group and 10 actions in the Sales/Mortgages group. He would like to import all 10 actions from the Credit Cards group and only two actions from the Mortgage group into one decision strategy. What is the minimum number of Proposition Data components he needs to use in his strategy?

U+ Bank, a retail bank, does not want to annoy customers by offering them a mortgage refinance option if they have less than 5% to pay off on their loan, although it would be profitable for the bank. Which engagement policy condition best suits this requirement?

U+ Bank has recently implemented a cross-sell on the web microjourney and is satisfied with the results. The bank now wants these Next-Best-Action recommendations to be delivered via outbound communication channels. Select two outbound channels that U+ bank can use to deliver Next-Best-Action recommendations. (Choose Two).

Reference module: Creating and understanding decision strategies

In a Prioritize component, the top action can be determined based on the value of ________ .

MyCo, a telecom company, has a new requirement to track customer responses over a period of 20 days. What do you need to create to start tracking customer responses for the given period of time?

An outbound run identifies 100 Standard Card offers, 50 on email and 50 on the SMS channel. If the above volume constraint is applied, how many actions will be delivered by the outbound run?

A bank is currently displaying a group of mortgage offers to its customers on their website. The bank wants to suppress the mortgage group for 1 month if a customer ignores three mortgage offers within that group. How do you define the suppression rule for this requirement?

Reference module: Testing engagement policy conditions using audience simulation

U+ Bank, a retail bank, recently implemented a project in which mortgage offers are presented to qualified customers when the customers log in to the web self-service portal. As one of the offers is not performing well, the business wants to understand how many customers qualify for the offer. As a Decisioning Consultant, which simulation do you run to check how many customers qualify for an action?

The arbitration factor that allows you to assign financial values to actions is called: _________.

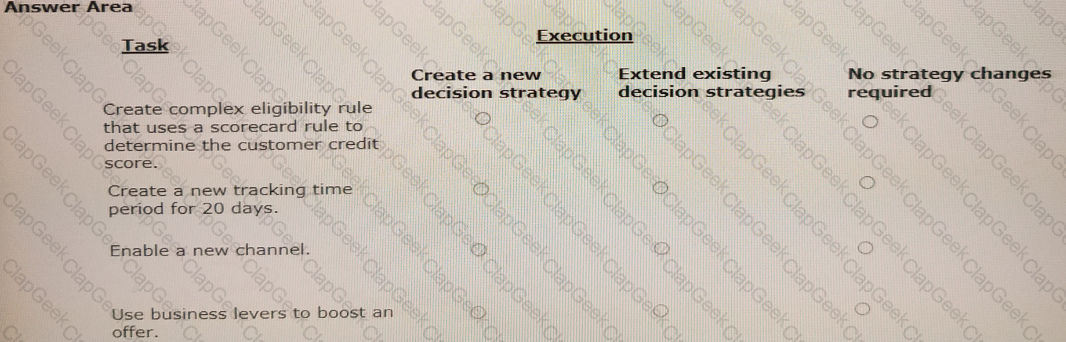

U+ Bank, a retail bank, presents offers on its website by using Pega Customer Decision Hub™. The bank wants to leverage Customer Decision Hub capabilities to present relevant offers to qualified customers. As a decisioning consultant, you are responsible for configuring the business requirements with the Next-Best-Action Designer, which involves several tasks. To accomplish these tasks, you might have to use auto-generated decision strategies, create new decision strategies, or edit existing strategies.

In the Answer Area, select the correct execution for each Task.

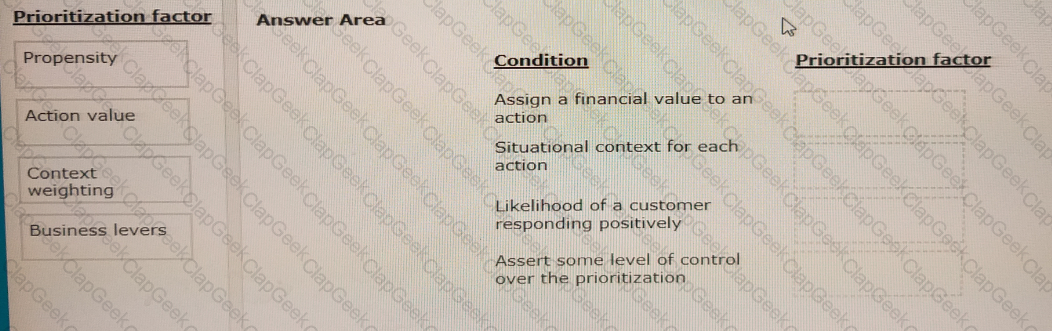

You are the decisioning consultant on an Al-powered one-to-one customer engagement implementation project. You are asked to design the next-best-action prioritization expression that balances the customer needs with the business objectives.

What factor do you consider in the prioritization expression?

A bank wants to leverage the Next-Best-Action capability of Pega Customer Decision Hub™ to promote new offers to each customer on their website. What information does Pega Customer Decision Hub send back to the website in response to the real-time container request?

You are a decisioning consultant responsible for configuring offer prioritization for home loan offers based on the business requirements.

Select each prioritization factor on the left and drag it to the correct condition on the right.

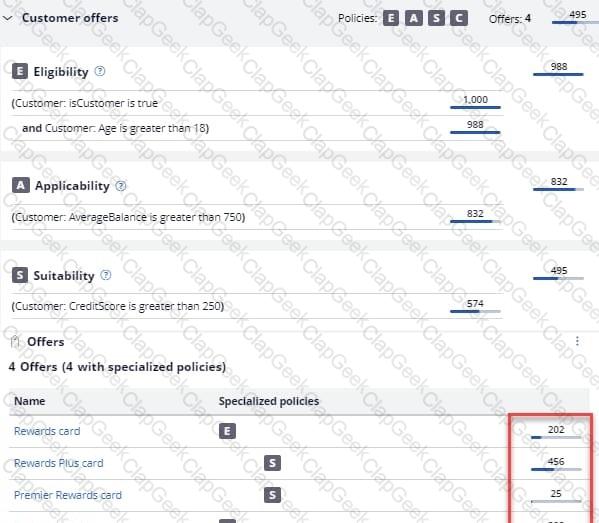

U+, a retail bank, runs an audience simulation with only engagement policies in scope (no arbitration) to understand how its engagement policy conditions perform for its sampled customers. The image above shows the results of this simulation. What do the action-level numbers indicate?

In Pega Customer Decision Hub™, the characteristics of an action are defined by using

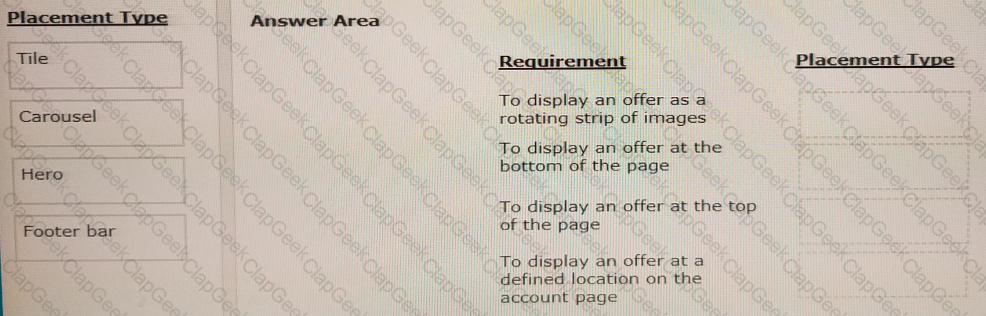

U+ Bank has decided to use the Pega Customer Decision Hub™ to recommend more relevant banner ads to its customers when they visit the personal portal.

Select each placement type on the left and drag it to the correct requirement on the right.

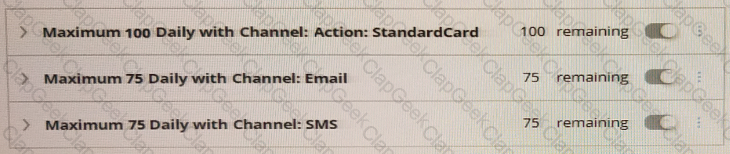

An outbound run identifies 150 Standard card offers, 75 on email, and 75 on the SMS channel.

If the following volume constraint is applied, how many actions are delivered by the outbound run?

Reference module: Analyzing the effect of business changes using Pega Scenario Planner.

Myco, a telco, has recently implemented a project in which data plan offers are presented to qualified customers. Myco wants to understand the impact to revenue if the business introduces a new data plan offer. As a Decisioning Consultant, which simulation do you run to meet the requirement?

U+ Bank, a retail bank, uses the Business Operations Environment to perform its Business changes. The bank carries out these changes in the Pega Customer Decision Hub portal by using revision management features or the 1:1 operations Manager Portal.

Customers see credit card offers based on various engagement policies on the U+ Bank website. The bank wants to update the underlying decision strategy of an engagement policy condition. In which portal do you create the change request to fulfill new business requirement?

Myco, a telco, currently promotes 24-month contracts with a free handset plus data plan, for example, MyPhone 11 and unlimited calls and data. The business structure has a sales issue/plans group that contains all actions, which are currently handsets.

Now, the company wants to introduce some new plans without handsets. So, the term handsets no longer applies to the new actions. At what level in the hierarchy can you rename the plans to reflect the new situation?

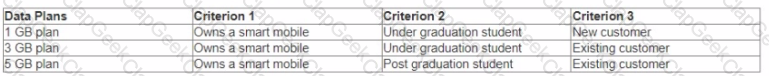

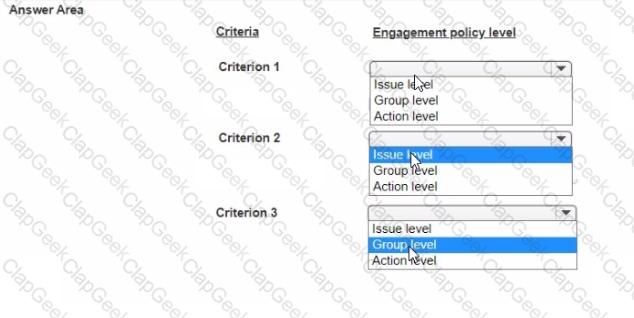

MyCo, a telecom company, developed a new data plan group to suit the needs of its customers The following table lists the three data plan actions and the criteria that customers must satisfy to qualify for the offer:

How do you configure the engagement policies to implement this requirement? Choose the engagement policy level that is best-suited for each criterion.

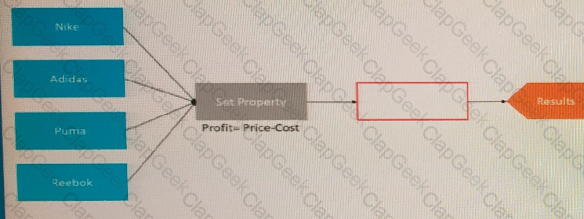

The following decision strategy outputs the most profitable shoe a retailer can sell. The profit is the selling Price of the shoe, minus the Cost to acquire the shoe.

The details of the shoes are provided in the following table:

What is the number of outputs that each component has?

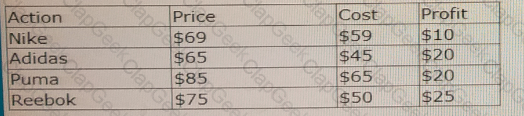

Reference module: Detecting unwanted bias

MyCo, a telco, has introduced mobile data packages for students. As a policy, MyCo does not want to discriminate based on gender when presenting the offers. As a Decisioning Consultant, how do you configure the ethical bias policy to allow no bias?

As a Decisioning Consultant, you are tasked with configuring the ethical bias policy. Which context do you need to select to add bias fields?

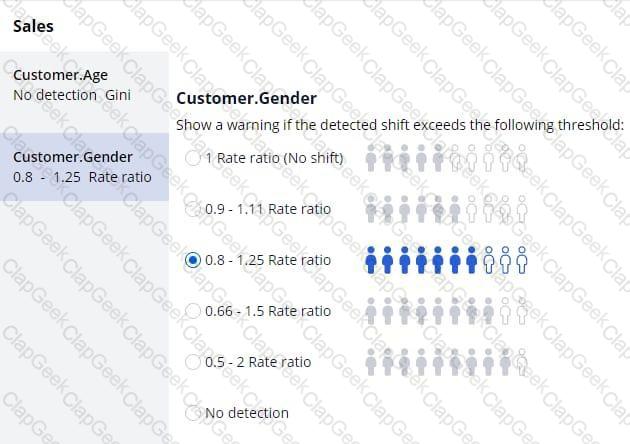

U+ bank uses a decision table to return a label for a customer. Examine the above decision table and select which label is returned for a customer with a CLV score of 550 and a LOW propensity to leave

Reference module: Creating and understanding decision strategies

In a decision strategy, to use a customer property in an expression, you _____.

As a Decisioning consultant, you are tasked with running an audience simulation to test the engagement policy conditions. Which statement is true when the simulation scope is: Audience simulation with engagement policy and arbitration?

In an organization, customer actions are applicable to various business issues. What is the best way to organize them?

U+ Bank has recently implemented Pega Customer Decision Hub"M. As a first step, the bank went live with the contact center to improve customer engagement. Now, U+ Bank wants to extend its customer engagement through the web channel. As a decisioning consultant, you have created the new set of actions, the corresponding treatments, and defined a new trigger in the Next-Best-Action Designer for the new web channel.

What else do you configure for the new treatments to be present in the next-best-action recommendations?

U+ Bank wants to use Pega Customer Decision Hub™ to display a credit card offer, the Standard Card, to every customer who logs in to the bank website.

What three of the following artifacts are mandatory to implement this requirement? (Choose Three)

U+ Bank has recently introduced a few mortgage offers that are presented to qualified customers on its website. The business now wants to prevent offer overexposure, as overexposure negatively impacts the customer experience.

Select the correct suppression rule for the requirement: If a customer is presented on the website with the same offer five times in the last 14 days, do not show the same offer to that customer for the next 10 days.

In a Decisioning Strategy, which decision component is required to enable access to the Customer properties like age, income, etc.?

Reference module: Creating and understanding decision strategies

Enrichment decision components provide the ability to ________.

Reference module: Sending offer emails

What is best practice for designing an action flow?

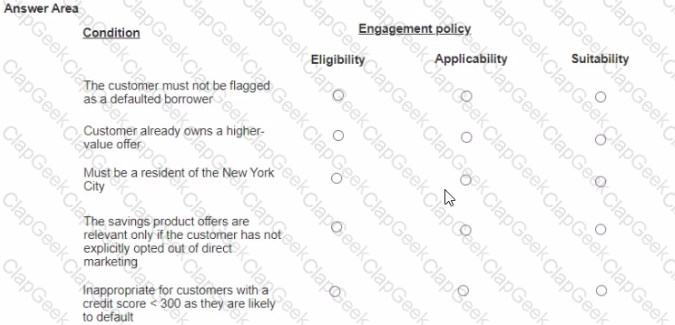

U+ Bank a retail bank, has recently implemented a project in which credit card offers are presented to qualified customers when they log in lo the web self-service portal. The bank added engagement policy conditions to show the offers based on the banks requirements.

In the Answer Area select the correct engagement policy for each condition.

A bank wants to leverage Pega Customer Decision Hub’s Next-Best-Action capability to promote new offers to each customer on their website. Which artifact do you need to configure to manage the communication between the Customer Decision Hub and external channels?

U+ Bank uses a scorecard rule in a decision strategy to compute the mortgage limit for a customer. U+ Bank updated their scorecard to include a new property in the calculation: customer income.

What changes do you need to make in the decision strategy for the updated scorecard to take effect?

The U+ Bank marketing department currently promotes various home loan offers to qualified customers. Now, the bank does not want customers to receive more than four promotional emails per quarter, regardless of past responses to that action by the customer.

Which option allows you to implement the business requirement?

A customer contacts a bank to resolve a credit card dispute. After dispute resolution, Next-Best-Action displays a set of sales offers that a Customer Service Representative can present to the customer.

Which feature of Next-Best-Action helps the Customer Service Representative decide on the offer to present to the customer?