Assess benchmarking as an approach to analysing an organisations performance.

See the complete answer below in Explanation.

Benchmarking as an Approach to Analyzing Organizational Performance

Introduction

Benchmarking is aperformance measurement toolused by organizations tocompare their processes, products, or servicesagainst industry standards, competitors, or best practices. It helps organizationsidentify performance gaps, set improvement targets, and enhance competitive advantage.

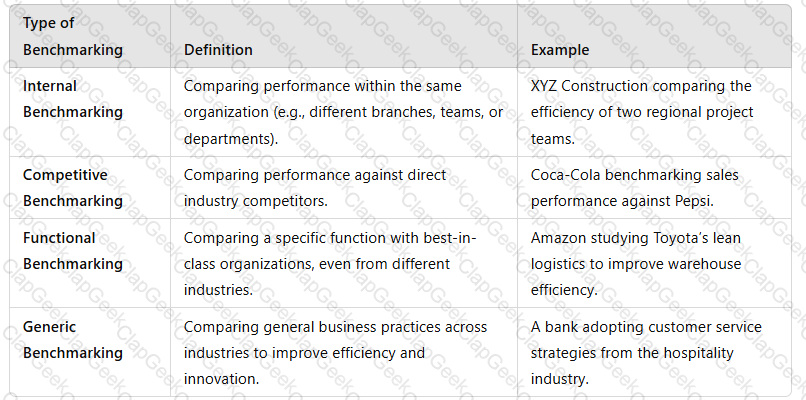

There are different types of benchmarking, includinginternal, competitive, functional, and generic benchmarking, each serving different strategic objectives.

1. Types of Benchmarking

Organizations can adopt different benchmarking approaches based on their goals:

A screenshot of a computer

Description automatically generated

A screenshot of a computer

Description automatically generated

2. How Benchmarking Helps in Performance Analysis

Benchmarking providesquantifiable insightsto assess and improve organizational performance in key areas:

✅Identifies Performance Gaps– Highlights areas where an organization lags behind competitors or industry best practices.✅Improves Operational Efficiency– Helps streamlinesupply chain, production, and customer service processes.✅Enhances Strategic Decision-Making– Supports data-driven decisions forresource allocation, pricing strategies, and process optimization.✅Drives Continuous Improvement– Encourages a culture ofinnovation and best practice adoption.✅Boosts Competitive Advantage– Enables organizations to stay ahead in their market by implementing superior processes.

????Example:Aretail chain benchmarking delivery speed against Amazonmay adoptAI-driven inventory managementto reduce delays.

3. Advantages of Benchmarking

✅Objective Performance Measurement– Uses industry data to providerealistic performance targets.✅Encourages Best Practice Adoption– Helps companieslearn from successful competitors.✅Enhances Cost Efficiency– Identifiesareas for cost reduction and resource optimization.✅Facilitates Strategic Growth– Helps companies improvecustomer experience, product innovation, and market positioning.

????Example:McDonald's benchmarked Starbucks' digital loyalty program, leading to the launch ofMyMcDonald’s Rewards, improving customer retention.

4. Limitations of Benchmarking

❌Limited to Available Data–Confidential industry datamay not always be accessible.❌Lack of Context– Differences inbusiness models, resources, and market conditionscanmake direct comparisons misleading.❌Focus on Imitation Over Innovation– Firms may focus too much oncopying competitorsrather than developing unique strategies.❌Resource-Intensive– Conducting in-depth benchmarking requirestime, expertise, and financial investment.

????Example:XYZ Construction benchmarking against a large multinationalmay find certain strategies unrealistic due toscale differences.

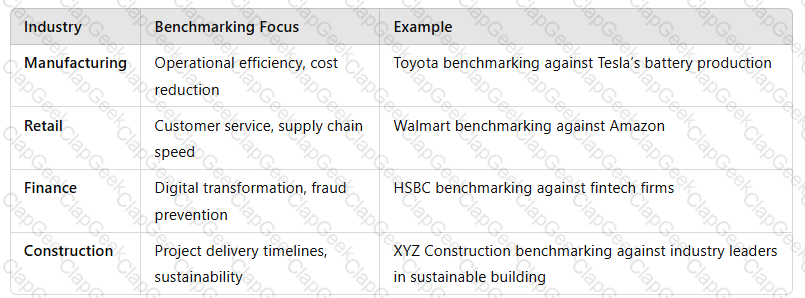

5. Application of Benchmarking in Different Sectors

Organizations across industries use benchmarking for performance analysis:

A screenshot of a computer

Description automatically generated

A screenshot of a computer

Description automatically generated

Conclusion

Benchmarking is aneffective performance analysis toolthat helps organizationsidentify gaps, adopt best practices, and enhance competitiveness. However, it must be used carefully toavoid blind imitation and consider contextual differences. When integrated with other strategic models (e.g., SWOT, Balanced Scorecard), benchmarking provides apowerful framework for continuous improvement and strategic growth.

Organisations in the private sector often need to make decisions regarding financing, investment and dividends.Discuss factors that affect these decisions.

See the complete answer below in Explanation.

Factors Affecting Financing, Investment, and Dividend Decisions in Private Sector Organizations

Introduction

Private sector organizations must carefully balancefinancing, investment, and dividend decisionsto ensurefinancial stability, profitability, and shareholder satisfaction. These decisions are influenced byinternal financial health, external economic conditions, market competition, and regulatory requirements.

This answer examines thekey factors affecting financing, investment, and dividend policiesin private sector companies.

1. Factors Affecting Financing Decisions????(How Companies Raise Capital?)

Financing decisionsdetermine how businessesfund operations, expansion, and debt repayment.

1.1 Cost of Capital????(Debt vs. Equity Considerations)

✅Why It Matters?

Companies choose betweendebt financing (bank loans, bonds)andequity financing (selling shares)based on thecost of capital.

Higher interest ratesmake debt financing expensive, while equity financing dilutes ownership.

????Example:

A startup may prefer equity financingto avoid immediate debt repayments.

A profitable company may use debtdue totax advantages on interest payments.

????Key Takeaway:Companies aim tominimize capital costswhile maintaining financial flexibility.

1.2 Company’s Creditworthiness & Risk Tolerance⚖️

✅Why It Matters?

Stronger credit ratingsallow companies to secure loans atlower interest rates.

Riskier businesses maystruggle to secure financingor facehigh borrowing costs.

????Example:

Apple can easily issue corporate bondsdue to its strong financial position.

A high-risk startup may have to offer higher interest rateson its debt.

????Key Takeaway:Financially stable firms havemore funding options at lower costs.

1.3 Economic Conditions????(Market Trends & Inflation)

✅Why It Matters?

Ineconomic downturns, companies avoid excessive borrowing.

Inflation and interest rate hikesincrease financing costs.

????Example:

Duringrecessions, companies reduce borrowing to avoidhigh debt risks.

In abooming economy, firms take loans toexpand production and capture market share.

????Key Takeaway:Businesses adjust financing strategies based oneconomic stability and interest rates.

2. Factors Affecting Investment Decisions????(Where and How Companies Invest Capital?)

2.1 Expected Return on Investment (ROI)????

✅Why It Matters?

Companies evaluate potentialprofits from investmentsbefore committing capital.

High-ROI projects are prioritized, while low-ROI investments are avoided.

????Example:

Tesla invests in battery technologydue to high future demand.

A retail chain avoids investing in struggling marketswith low profitability.

????Key Takeaway:Businesses prioritizehigh-return investmentsthat align with strategic goals.

2.2 Risk Assessment & Diversification????

✅Why It Matters?

Companies assessmarket, operational, and financial risksbefore investing.

Diversification reduces reliance on asingle revenue source.

????Example:

Amazon diversified into cloud computing (AWS)to reduce dependence on e-commerce sales.

Oil companies invest in renewable energyto hedge against declining fossil fuel demand.

????Key Takeaway:Investment decisions focus onbalancing risk and opportunity.

2.3 Availability of Internal Funds vs. External Borrowing????

✅Why It Matters?

Companies useretained earningswhen available toavoid debt costs.

When internal funds are insufficient, theyborrow or raise equity capital.

????Example:

Google reinvests profits into AI and software developmentinstead of taking loans.

A new airline expansionmay requiredebt financing for aircraft purchases.

????Key Takeaway:Investment decisions depend onfund availability and cost considerations.

3. Factors Affecting Dividend Decisions????(How Companies Distribute Profits to Shareholders?)

3.1 Profitability & Cash Flow Stability????

✅Why It Matters?

Profitable companiespay higher dividends, while struggling firms reduce payouts.

Strong cash flow ensuresconsistent dividend payments.

????Example:

Microsoft pays regular dividendsdue to itssteady revenue stream.

A startup reinvests all profitsinto business growth instead of paying dividends.

????Key Takeaway:Onlyprofitable, cash-rich companiessustain high dividend payouts.

3.2 Growth vs. Payout Trade-Off????

✅Why It Matters?

High-growth firmsreinvest profitsfor expansion instead of paying high dividends.

Mature companies withstable profitsfocus on rewarding shareholders.

????Example:

Amazon reinvests heavily in logistics and AIrather than paying high dividends.

Coca-Cola pays consistent dividendsas its industry growth is slower.

????Key Takeaway:Companies balancegrowth investment and shareholder returns.

3.3 Shareholder Expectations & Market Perception????

✅Why It Matters?

Investors expect dividends, especially inblue-chip and income-focused stocks.

Suddendividend cutscan signalfinancial trouble, affecting share prices.

????Example:

Unilever maintains stable dividendsto attract income-focused investors.

Tesla does not pay dividends, focusing on long-term growth and innovation.

????Key Takeaway:Dividend policies affectinvestor confidence and stock valuation.

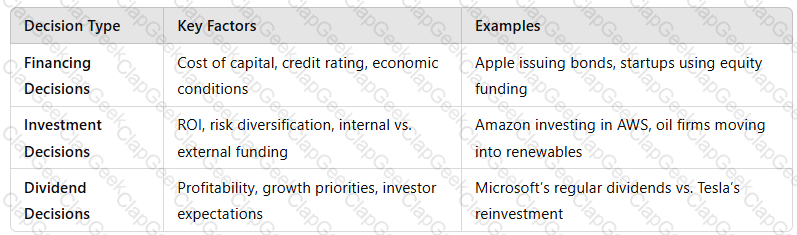

4. Summary: Key Factors Influencing Financial Decisions

A screenshot of a computer

Description automatically generated

A screenshot of a computer

Description automatically generated

Key Takeaway:Companiesbalance financing, investment, and dividend decisionsbased onprofitability, risk assessment, and market conditions.

5. Conclusion

Private sector companies makestrategic financial decisionsby evaluating:

✅Financing Needs:Debt vs. equity, cost of borrowing, and risk management.✅Investment Priorities:Expected ROI, business growth, and market opportunities.✅Dividend Strategy:Balancing shareholder returns and reinvestment for growth.

Understanding these factors helps businessesmaximize financial performance, shareholder value, and long-term sustainability.

Explain how culture and historic influences can impact upon a business’s strategic decisions and positioning within the marketplace

See the complete answer below in Explanation.

How Culture and Historic Influences Impact Strategic Decisions and Market Positioning

A business’sstrategic decisionsandpositioning within the marketplaceare shaped by bothorganizational cultureandhistorical influences. These factors affect how a companydevelops strategy, interacts with customers, manages employees, and competes globally.

1. The Role of Organizational Culture in Strategic Decisions

Organizational culture is theshared values, beliefs, and behaviorswithin a company. It influencesdecision-making, innovation, and competitive advantage.

????How Culture Affects Strategy

✅Risk Appetite– A culture that embraces innovation (e.g., Google) will invest in R&D, while risk-averse cultures (e.g., traditional banks) focus on stability.✅Decision-Making Speed– Hierarchical cultures (e.g., Japanese firms) rely on consensus, while Western firms (e.g., Apple) may have centralized decision-making.✅Customer Engagement– Acustomer-centric culture(e.g., Amazon) leads to investment in personalization and AI-driven recommendations.

????Example:

Toyota’s Kaizen Culture (Continuous Improvement)has shaped itslean manufacturing strategy, giving it a competitive advantage in cost efficiency.

2. How Historic Influences Shape Business Strategy

Historical events,past business performance, economic trends, and industry evolutionshape how businessesposition themselves in the marketplace.

????How History Affects Strategy

✅Legacy of Innovation or Conservatism– Companies with a history ofinnovation(e.g., IBM, Tesla) continuously push boundaries, while firms with traditional roots (e.g., British banks) focus on risk management.✅Economic Crises and Financial Stability– Businesses that survived financial crises (e.g., 2008 recession) tend to developrisk-averse financial strategies.✅Market Reputation and Consumer Perception– A stronghistorical reputationcan be leveraged for branding (e.g., Rolls-Royce’s luxury image).

????Example:

Legonearly went bankrupt in the early 2000s, leading it toredefine its strategy, focus ondigital gaming partnerships, and revive its brand.

3. The Influence of National and Corporate Culture on Global Positioning

When expanding globally, businesses mustalign their strategies with different cultural expectations.

????How Culture Affects Global Market Entry

✅Consumer Preferences– Fast food chainsadapt menusfor local cultures (e.g., McDonald's in India offers vegetarian options).✅Negotiation & Communication Styles– Business negotiations inChinaemphasize relationships ("Guanxi"), whileWestern firmsprioritize efficiency.✅Leadership and Management Approaches–German firmsemphasize engineering precision, whileSilicon Valley firmsprioritize agility and experimentation.

????Example:

IKEAmodifies store layouts in different countries—small apartments in Japan vs. large home spaces in the U.S.

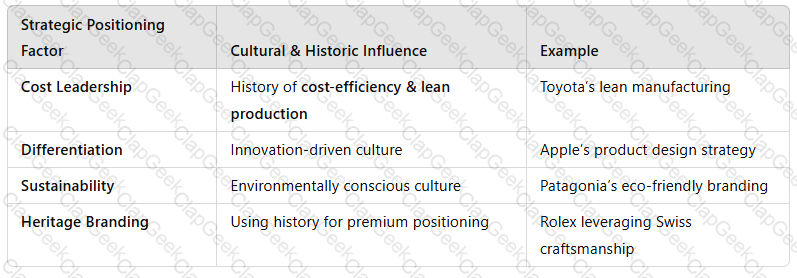

4. Strategic Positioning Based on Cultural & Historic Factors

A company’s historical and cultural influences define itspositioning strategy:

A screenshot of a white box

Description automatically generated

A screenshot of a white box

Description automatically generated

Conclusion

A business’sstrategic decisions and market positioningare deeply influenced byorganizational culture, national culture, and historical performance. Companies thatleverage their cultural strengths and adapt to market historycan achievelong-term competitive advantage.

XYZ is a high fashion clothing designer and wishes to complete a benchmarking exercise. Discuss priority dimensions to be measured in the benchmarking exercise and propose a strategy for completing the exercise

See the complete answer below in Explanation.

Benchmarking Exercise for XYZ – A High Fashion Clothing Designer

Introduction

Benchmarking is astrategic performance measurement toolthat helps businesses compare theirprocesses, products, and strategieswith industry leaders to identify areas for improvement.

As ahigh fashion clothing designer, XYZ must focus onkey priority dimensionssuch asproduct quality, supply chain efficiency, sustainability, brand positioning, and customer engagement. A structuredbenchmarking strategyensures that XYZ can achievecompetitive advantage, optimize operations, and align with industry best practices.

1. Priority Dimensions to be Measured in Benchmarking

XYZ should focus on the followingfive key benchmarking dimensionsto enhance its competitiveness in the luxury fashion market:

1. Product Quality and Design Innovation

✅Why it’s important?

High fashion brands compete onpremium materials, craftsmanship, and exclusivity.

Quality affectsbrand reputation, pricing strategy, and customer loyalty.

????Example:XYZ can benchmark againstGucci or Chanelby comparing fabric sourcing, production techniques, and unique design elements.

2. Supply Chain Efficiency and Lead Times

✅Why it’s important?

Speed-to-market iscritical in high fashion, especially for seasonal collections.

Efficient supply chains reduce costs and enhanceinventory management.

????Example:Zara benchmarks against luxury brandsto optimize supply chains while maintaining affordability.

????Key Metrics to Benchmark:

Supplier lead times (raw materials to finished goods).

Production cycle time (design to retail store).

Logistics and distribution efficiency.

3. Brand Positioning and Market Perception

✅Why it’s important?

A high fashion brand’s success depends onprestige, exclusivity, and perceived value.

Benchmarking against top competitors helps XYZ maintaina premium brand image.

????Example:XYZ can compare itsmarketing strategies, social media presence, and celebrity endorsementswithLouis Vuitton or Dior.

????Key Metrics to Benchmark:

Brand awareness and perception (customer surveys).

Pricing strategy compared to competitors.

Effectiveness of marketing campaigns and influencer collaborations.

4. Sustainability and Ethical Sourcing

✅Why it’s important?

Consumers expecteco-friendly, ethically produced fashion.

Sustainable brands gain a competitive edgeand attract Gen Z and millennial buyers.

????Example:Stella McCartney’s ethical fashion modelis a benchmark forsustainable materials and responsible sourcing.

????Key Metrics to Benchmark:

Use of sustainable materials (organic, recycled fabrics).

Ethical supplier compliance withfair labor practices.

Carbon footprint reduction in production and logistics.

5. Customer Engagement and Experience

✅Why it’s important?

Luxury brands thrive onpersonalized customer experiences and loyalty programs.

Omnichannel retail(physical stores + digital platforms) enhances sales and retention.

????Example:Burberry’s digital transformationprovides a seamlessluxury online shopping experience.

????Key Metrics to Benchmark:

Online vs. in-store customer engagement levels.

AI-driven personalization in e-commerce.

Customer service responsiveness and return policies.

2. Proposed Strategy for Completing the Benchmarking Exercise

To complete the benchmarking process successfully, XYZ should follow astructured benchmarking approachusing the5-step process:

Step 1: Identify Benchmarking Objectives

????Define what XYZ wants to achieve (e.g.,reducing lead times, improving sustainability).????Selectbenchmarking partners(competitors, industry leaders, cross-industry comparisons).

Step 2: Data Collection & Research

????Useprimary and secondary researchto gather data:

Primary Research:Surveys, interviews, supplier audits.

Secondary Research:Competitor reports, industry data, fashion indexes.

????Example:Studyingannual sustainability reports from high fashion brandsto benchmark against sustainability best practices.

Step 3: Analyze Performance Gaps

????Compare XYZ’scurrent performance metricswith industry benchmarks.????Identifygaps and improvement opportunities(e.g., faster supply chain, better brandmarketing).

????Example Analysis:

XYZ’ssupply chain lead time = 60 daysvs.benchmark brand = 30 days→ Strategy needed for optimization.

Step 4: Develop and Implement Improvement Strategies

????SetSMART objectives(Specific, Measurable, Achievable, Relevant, Time-bound).????Adjustsupply chain processes, brand positioning, marketing strategies, and customer experience initiatives.

????Example Action Plan:

Supply Chain:Partner withlocal European suppliersto reduce lead times.

Sustainability:Introduceorganic cotton & cruelty-free leatherin the next collection.

Step 5: Continuous Monitoring and Review

????Regularly review benchmarking outcomes.????Adjust strategies to remain competitive in the evolving high fashion market.

????Example:Chanel adapts marketing campaignsevery season to maintain exclusivity and desirability.

Conclusion

Benchmarking allows XYZ to measureproduct quality, supply chain efficiency, brand positioning, sustainability, and customer engagementagainsthigh fashion industry leaders. A structured5-step benchmarking processensures that XYZ continuously improves itsstrategic performance and maintains a competitive edge.

Why is it important for an organisation to measure performance? Describe one tool that can be used to measure performance

See the complete answer below in Explanation.

Importance of Measuring Performance & Performance Measurement Tool

Introduction

Performance measurement is essential for organizations to evaluate theirefficiency, effectiveness, and strategic success. It providesquantifiable insightsinto business operations, helping companies makedata-driven decisions, improve productivity, and maintain competitive advantage.

To achieve this, organizations usevarious performance measurement tools. One widely used tool is theBalanced Scorecard (BSC), which provides aholistic approachto measuring performance across different business areas.

1. Importance of Measuring Performance

Organizations must measure performance to achieve the following benefits:

1.1 Supports Strategic Decision-Making

✅Helps businessesalign operationswith strategic goals.✅Identifiesareas needing improvement or investment.

????Example:A company analyzing supply chain delays can makeinformed decisionson sourcing alternative suppliers.

1.2 Improves Efficiency and Productivity

✅Tracksoperational effectivenessto reduce waste and costs.✅Ensures departments meetKPIs (Key Performance Indicators).

????Example:Amanufacturer measuring production efficiencycan identifybottlenecks and streamline processes.

1.3 Enhances Customer Satisfaction and Quality Control

✅Monitoring performance ensureshigh product/service quality.✅Helps companies respond tocustomer expectations and feedback.

????Example:A retail company trackingcustomer complaint resolution timescan improve customer service.

1.4 Ensures Financial Stability and Profitability

✅Measuresprofit margins, cost efficiency, and revenue growth.✅Assists inbudgeting and financial planning.

????Example:A business monitoringcash flow and profitability ratioscan detect financial risks early.

1.5 Supports Continuous Improvement and Benchmarking

✅Allows companies tocompare their performance with competitors.✅Encourages aculture of continuous improvement.

????Example:A company benchmarkingits sustainability metricsagainst industry leaders canenhance CSR strategies.

2. Performance Measurement Tool – The Balanced Scorecard (BSC)

One widely used performance measurement tool is theBalanced Scorecard (BSC).

2.1 Explanation of the Balanced Scorecard

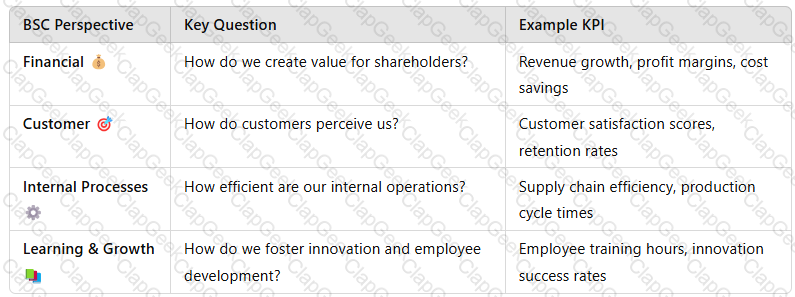

TheBalanced Scorecard (BSC), developed byKaplan and Norton, measures performance acrossfour key perspectives:

A screenshot of a computer

Description automatically generated

A screenshot of a computer

Description automatically generated

2.2 Application of BSC in Performance Measurement

✅Holistic View:Measuresfinancial and non-financialperformance.✅Strategic Alignment:Ensuresall departments contribute to business goals.✅Data-Driven Decision-Making:Provides insights forprocess improvements and competitive positioning.

????Example:Alogistics companyimplementing BSC could track:

Financial:Cost per delivery

Customer:Delivery accuracy and satisfaction scores

Internal Processes:Warehouse efficiency

Learning & Growth:Employee training on automation tools

3. Advantages and Limitations of the Balanced Scorecard

✅Advantages✔Aligns performance measurement withbusiness strategy.✔Ensuresbalanced focusacross financial and operational areas.✔Encouragescontinuous improvementthrough KPI tracking.

❌Limitations✖Can becomplex and time-consumingto implement.✖Needsregular updatesto remain relevant.✖May requirecultural changefor adoption across all departments.

Conclusion

Measuring performance is essential forstrategic decision-making, operational efficiency, customer satisfaction, financial stability, and continuous improvement. TheBalanced Scorecard (BSC)is apowerful toolthat provides acomprehensive performance assessment, helping organizations maintain asustainable competitive advantage.

Compare and contrast an aggressive and conservative approach to business funding.

See the complete answer below in Explanation.

Comparison of Aggressive vs. Conservative Business Funding Approaches

Introduction

Businesses adopt differentfunding strategiesbased on theirrisk tolerance, growth objectives, and financial stability. Two contrasting approaches to business funding are:

Aggressive Funding Approach– Focuses onhigh-risk, high-reward strategieswithmore debt and short-term financingto fuel rapid expansion.

Conservative Funding Approach– Emphasizesfinancial stability, risk aversion, and long-term security, often relying onequity and retained earningsto fund operations.

Each approach has advantages and risks, influencing a company’sliquidity, cost of capital, and financial sustainability.

1. Aggressive Business Funding Approach????(High Risk, High Reward)

Definition

Anaggressive funding strategyinvolves maximizingshort-term debt, high leverage, and minimal cash reservestoaccelerate growth and expansion.

✅Key Characteristics:

Relies heavily on debt financing(bank loans, corporate bonds, short-term credit).

Prioritizes rapid growth and high returnsover financial security.

Uses minimal equity financingto avoid ownership dilution.

Maintains low cash reserves, assuming cash flows will cover liabilities.

????Example:

Startups and tech firms (e.g., Tesla, Uber, Amazon in early years)oftenborrow aggressivelyto scale rapidly.

Private equity firmsfund acquisitions using high leverage to maximize returns.

Advantages of Aggressive Funding

✔Faster business expansion– Capital is readily available for investments.✔Higher return potential– More funds are allocated to revenue-generating activities.✔Lower equity dilution– Existing shareholders maintain control as funding is primarily debt-based.

Disadvantages of Aggressive Funding

❌High financial risk– Heavy debt increases vulnerability to economic downturns.❌Liquidity problems– Low cash reserves can cause issues during slow revenue periods.❌Higher borrowing costs– Lenders charge higher interest due to the risk involved.

????Best for:Fast-growing companies, high-risk industries, and businesses with predictable cash flows.

2. Conservative Business Funding Approach????(Low Risk, Long-Term Stability)

Definition

Aconservative funding strategyfocuses onlow debt levels, high liquidity, and long-term financingto ensurefinancial stability and steady growth.

✅Key Characteristics:

Uses retained earnings and equity financingover debt.

Minimizes reliance on short-term creditto avoid financial pressure.

Maintains high cash reservesfor financial security.

Focuses on steady, sustainable growthrather than rapid expansion.

????Example:

Berkshire Hathaway (Warren Buffett’s company)follows aconservative funding model, relying on retained earnings rather than excessive debt.

Family-owned businessesoften prioritize financial stability over rapid expansion.

Advantages of Conservative Funding

✔Lower financial risk– Reduces dependence on external creditors.✔Stable cash flow– Ensures business continuity during economic downturns.✔Better credit rating– Stronger financial health allows for lower borrowing costs if needed.

Disadvantages of Conservative Funding

❌Slower business growth– Limited access to capital can restrict expansion.❌Missed market opportunities– Competitors with aggressive funding may outpace the company.❌Higher cost of capital– Equity financing (selling shares) dilutes ownership and reduces profit per share.

????Best for:Established businesses, risk-averse industries, and companies focusing on long-term sustainability.

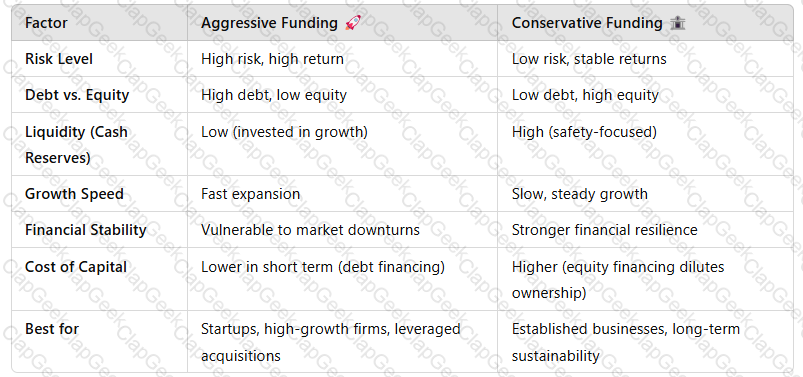

3. Comparison Table: Aggressive vs. Conservative Funding Approaches

A screenshot of a computer screen

Description automatically generated

A screenshot of a computer screen

Description automatically generated

Key Takeaway:The best funding approach depends onindustry, company stage, and risk appetite.

4. Which Approach Should a Business Use?

✅Aggressive Approach is Ideal For:

Startups & High-Growth Companies– Needfast capitalto capture market share.

Businesses in Competitive Markets– Companies that mustoutpace rivals through aggressive expansion.

Private Equity & Leveraged Buyouts– Maximizing returns throughhigh debt strategies.

✅Conservative Approach is Ideal For:

Mature & Stable Businesses– Companies prioritizingsteady revenue and financial security.

Family-Owned Enterprises– Owners preferlow debt and long-term growth.

Risk-Averse Industries– Businesses inessential goods/services sectorswherestability is more important than rapid expansion.

Hybrid Approach: The Best of Both Worlds?

????Many businesses use a combination of both approaches, leveragingdebt for growth while maintaining financial stabilitythrough retained earnings and equity.

????Example:

Appleused a conservative strategy in its early years but adoptedaggressive funding for global expansionpost-2010.

5. Conclusion

The choice betweenaggressive and conservative fundingdepends on a company’sgrowth goals, financial risk tolerance, and industry conditions.

✅Aggressive funding maximizes short-term growthbut increases financial risk.✅Conservative funding ensures stabilitybut limits expansion speed.✅Most companies use a hybrid modelto balancegrowth and financial security.

Understanding these approaches helps businessesoptimize capital structure, manage risk, and align financing with strategic objectives.

Describe four drivers of internationalisation

See the complete answer below in Explanation.

Four Key Drivers of Internationalisation

Introduction

Internationalisation refers to theprocess of expanding business operations into international markets. Companies expand globally toincrease market share, access resources, reduce costs, and enhance competitiveness.

Several factors drive internationalisation, but the four key drivers are:

Market Drivers– Demand from global consumers.

Cost Drivers– Reducing production costs.

Competitive Drivers– Gaining an edge over rivals.

Government & Regulatory Drivers– Trade policies and incentives.

These factors influencebusiness strategy, supply chain management, and operational efficiencyin international markets.

1. Market Drivers????(Demand and Market Expansion)

Definition

Market drivers relate toconsumer demand, global branding opportunities, and standardization of products across different markets.

✅Why It Drives Internationalisation?

Companies seeknew customers and revenue streamsbeyond domestic markets.

Global branding createsstrong market presence and customer loyalty.

Similar customer preferences allow forproduct standardization and scalability.

????Example:McDonald's expands globallyby offeringconsistent branding and adapted menusto match local tastes.

????Key Takeaway:Businesses expand internationally totap into new markets, increase sales, and leverage brand recognition.

2. Cost Drivers????(Reducing Production and Operational Costs)

Definition

Cost drivers involvereducing manufacturing, labor, and supply chain costs by operating in lower-cost regions.

✅Why It Drives Internationalisation?

Labor cost savings– Companies move production tolow-cost countries (e.g., China, Vietnam, Mexico).

Economies of scale– Expanding operations globallylowers per-unit costs.

Access to cheaper raw materials– Firms relocate toresource-rich countriesfor lower procurement costs.

????Example:Apple manufactures iPhones in Chinadue tolower labor costs and supplier proximity.

????Key Takeaway:Companiesinternationalise to optimize costs, increase profit margins, and improve supply chain efficiency.

3. Competitive Drivers????(Gaining Market Advantage)

Definition

Competitive drivers push firms toexpand internationally to stay ahead of rivals, access new technologies, and strengthen market positioning.

✅Why It Drives Internationalisation?

Competing with global playersforces firms to expand or risk losing market share.

First-mover advantage– Entering new markets early buildsbrand dominance.

Access to innovation– Expanding to regions withadvanced R&D and skilled talentenhances competitiveness.

????Example:Tesla expanded into Chinato compete with local EV manufacturers and dominate the world’s largest electric vehicle market.

????Key Takeaway:Businesses internationalise tooutperform competitors, access innovation, and capture strategic markets.

4. Government & Regulatory Drivers????️(Trade Policies & Incentives)

Definition

Government policies, trade agreements, and financial incentives influencehow and where businesses expand internationally.

✅Why It Drives Internationalisation?

Free Trade Agreements (FTAs)reduce tariffs, making exports/imports more attractive.

Government incentives(e.g., tax breaks, subsidies) encourage foreign investments.

Favorable regulationsallow easier market entry and operations.

????Example:Car manufacturers set up plants in Mexicodue toNAFTA trade benefitsand lower import tariffs into North America.

????Key Takeaway:Businesses internationalisewhen government policies support market entry, trade facilitation, and investment incentives.

Conclusion

Internationalisation is driven bymarket demand, cost efficiencies, competitive pressures, and regulatory factors. Companies expand globally to:

✅Access new customersand increase revenue.✅Reduce coststhrough cheaper production and labor.✅Stay competitiveand gain market leadership.✅Leverage government trade policiesfor easier market entry.

Understanding these drivers helps businessesmake informed global expansion decisionswhile managing risks effectively.

Discuss supply and demand factors in foreign exchange

See the complete answer below in Explanation.

Supply and Demand Factors in Foreign Exchange

Introduction

Theforeign exchange (Forex) marketoperates on the fundamental principle ofsupply and demand, which determines currency values. Whendemand for a currency rises, its value appreciates, whilean oversupply causes depreciation.

Several factors influence thesupply and demandof foreign currencies, includinginterest rates, inflation, trade balances, investor sentiment, and geopolitical events.

This answer explores thekey supply and demand factors in Forex marketsand how they impact exchange rates.

1. Demand Factors in Foreign Exchange????????(What Increases Demand for a Currency?)

1.1 Interest Rate Differentials????(Higher Interest Rates Attract Capital Inflows)

✅Why It Affects Demand?

Investors seekhigher returns on savings and investments.

Higher interest ratesincrease demandfor the country’s currency.

????Example:

When theUS Federal Reserve raises interest rates, theUS dollar (USD) strengthensas global investors buyUSD-denominated assets.

????Key Takeaway:Countries withhigher interest rates attract more investors, increasing currency demand.

1.2 Inflation Rates????(Low Inflation Strengthens Currency Demand)

✅Why It Affects Demand?

Lower inflation preserves purchasing power, making the currency more attractive.

High inflationerodes currency value, reducing demand.

????Example:

TheSwiss Franc (CHF) remains strongdue to Switzerland’slow inflation and economic stability.

In contrast,Turkey’s Lira (TRY) depreciateddue to high inflation, reducing investor confidence.

????Key Takeaway:Stable inflation rates encourage demand for a currency, while high inflation weakens it.

1.3 Trade Balance & Current Account Surplus????(Export-Led Demand for a Currency)

✅Why It Affects Demand?

Atrade surplus(exports > imports) increases demand for a country’s currency.

Foreign buyers need the country’s currency topay for goods and services.

????Example:

China’s trade surplus increases demand for the Chinese Yuan (CNY)as global buyers purchase Chinese goods.

Germany’s strong exports strengthen the Euro (EUR)due to high international trade.

????Key Takeaway:Exporting nations experiencehigher currency demand, boosting value.

1.4 Investor Confidence & Speculation????(Market Sentiment Drives Demand)

✅Why It Affects Demand?

If investorsexpect a currency to appreciate, they buy more of it.

Safe-haven currencies seeincreased demand during global uncertainty.

????Example:

Gold and the US Dollar (USD) strengthen during economic crises, as investors seek stability.

Brexit uncertainty weakened the British Pound (GBP)as investors speculated on UK economic instability.

????Key Takeaway:Market psychology and speculation can drive short-term demand for a currency.

2. Supply Factors in Foreign Exchange????????(What Increases the Supply of a Currency?)

2.1 Central Bank Monetary Policy????(Money Supply & Interest Rate Adjustments)

✅Why It Affects Supply?

Central bankscontrol currency supplythrough interest rates and money printing.

Loose monetary policy (low rates, quantitative easing)increases money supply, depreciating currency.

????Example:

TheEuropean Central Bank (ECB) lowered interest ratesand introduced stimulus packages, increasing thesupply of Euros (EUR).

TheBank of Japan’s low-interest ratesincreased thesupply of Japanese Yen (JPY), making it weaker.

????Key Takeaway:More money supply weakens a currency, while tight monetary policy strengthens it.

2.2 Government Debt & Fiscal Policy????(Higher Debt Increases Currency Supply)

✅Why It Affects Supply?

Countries withhigh national debtmay increase money supply to cover obligations.

High debt reduces investor confidence, increasing supply as investors sell off the currency.

????Example:

TheUS dollar saw increased supplyduring the 2008 financial crisis due to stimulus packages.

Argentina’s peso weakenedas government debt rose, increasing peso supply in markets.

????Key Takeaway:High government debt can lead to more currency supply and depreciation.

2.3 Foreign Exchange Reserves & Currency Intervention????(Central Banks Selling Currency to Manage Value)

✅Why It Affects Supply?

Central banks buy/sell their currency tostabilize exchange rates.

Selling reservesincreases currency supply, reducing its value.

????Example:

China’s central bank occasionally sells Yuan (CNY)to keep it competitive in global markets.

Switzerland’s central bank has intervened to weaken the Swiss Franc (CHF)to support exports.

????Key Takeaway:Governments manipulate currency supply to stabilize economic conditions.

2.4 Import Demand & Trade Deficits????(More Imports Increase Currency Supply)

✅Why It Affects Supply?

Atrade deficit(imports > exports) increases supply of local currency in global markets.

Importers exchange local currency for foreign currency, increasing supply.

????Example:

The US has a persistent trade deficit, increasing thesupply of US dollars in foreign exchange markets.

The UK’s reliance on importshas contributed to GBP fluctuations.

????Key Takeaway:Countries withtrade deficits see higher currency supply, leading to depreciation.

3. Interaction of Supply & Demand in Foreign Exchange Markets

A white grid with black text

Description automatically generated

A white grid with black text

Description automatically generated

Key Takeaway:Exchange rates fluctuate based on thebalance between supply and demand.

4. Conclusion

The foreign exchange market operates based onsupply and demand dynamics, influenced by:

✅Demand Factors:

Interest Rates & Inflation– Higher rates strengthen demand.

Trade Balances– Export-driven economies see strong demand.

Investor Sentiment– Economic stability attracts investors.

✅Supply Factors:

Central Bank Policies– Money printing increases supply.

Government Debt– High debt increases supply, lowering value.

Trade Deficits– Import-heavy economies see currency depreciation.

Understanding these factors helps businesses and policymakersmanage foreign exchange risks and optimize international trade strategies.

Discuss 4 stages of the industry and product lifecycle and explain how this can impact upon a company’s business strategy.

See the complete answer below in Explanation.

Industry and Product Lifecycle Stages & Their Impact on Business Strategy

Introduction

TheIndustry and Product Lifecycle Modeldescribes how industries and products evolve over time, affectingmarket demand, competition, and profitability. The model consists offour stages—Introduction, Growth, Maturity, and Decline—each influencing a company’sstrategic decisions on marketing, pricing, production, and investment.

Companies mustadapt their business strategyat each stage to remain competitive, maximize profitability, and sustain long-term growth.

1. Four Stages of the Industry and Product Lifecycle

High R&D and marketing costs

Limited competition

Low sales volume | - High investment inproduct development & market awareness

Skimming or penetration pricingstrategy

Targetearly adopters& build brand identity | |2. Growth Stage????| - Rising sales & market demand

More competitors enter the market

Profitability increases

Scaling production | -Expand distribution & market reach

Enhance product differentiation

Increaseadvertising & brand positioning

Invest insupply chain efficiency| |3. Maturity Stage????| - Market saturation

Slower growth rate

Intense price competition

Peak profitability | -Cost-cutting & process optimization

Focus oncustomer loyalty & retention

Introducenew features & upgrades

Expand intonew markets| |4. Decline Stage????| - Market demand falls

Profit margins shrink

Product obsolescence

Competitor innovations take over | -Discontinue or rebrand the product

Shift tonew technology or innovation

Reduce production costs orexit the market|

2. Impact of Lifecycle Stages on Business Strategy

1. Introduction Stage – Market Entry Strategy????

Companies mustinvest heavilyinR&D, marketing, and infrastructureto introduce a new product or enter a new industry.

✅Strategic Decisions:

High R&D spending on innovation andpatent protection.

Pricing strategy:Eitherpremium pricing (skimming)for high-end customers orlow pricing (penetration)to gain market share quickly.

Targetearly adopters and niche customersto build brand awareness.

????Example:Tesla’sModel Slaunch in 2012 targeted early EV adopters, using ahigh-end pricing strategyto attract premium buyers.

2. Growth Stage – Expanding Market Share????

As demandincreases, companies mustscale operations, expand marketing, and stay ahead of competitors.

✅Strategic Decisions:

Expand intonew geographic marketsand increase production capacity.

Invest inadvertising and promotional campaignsto establish brand dominance.

Improveproduct differentiation(e.g., adding new features, improving design).

????Example:Apple’s iPhone growth strategyfocused on expanding intoemerging marketswhile continuously innovating hardware and software.

3. Maturity Stage – Maintaining Competitive Advantage????

Market saturation leads toslower growth, intense competition, and price wars. Companies mustfocus on cost efficiency and customer loyalty.

✅Strategic Decisions:

Implementcost-cutting measuresand optimize supply chains.

Shift focus tobrand loyalty programs and after-sales services.

Introduceproduct extensions, upgrades, or new modelsto sustain demand.

????Example:Coca-Colacontinues to dominate the mature soft drink market bylaunching new flavors (e.g., Coke Zero)and aggressive brand marketing.

4. Decline Stage – Managing Product or Market Exit????

When demand declines due tochanging consumer preferences or technological advancements, companies mustdecide whether to exit or reinvent the product.

✅Strategic Decisions:

Discontinue the productand shift focus to more profitable ventures.

Rebrand or repositionthe product to attract a niche market.

Diversify into new product categoriesto stay relevant.

????Example:Blockbuster failed to adaptin the decline stage, whereasNetflix transitioned from DVDs to streaming, ensuring survival.

Conclusion

TheIndustry and Product Lifecycle Modelguides companies in making strategic decisions at each stage. To succeed, businesses mustadapt their pricing, marketing, investment, and innovation strategiesaccordingly. Organizations thatfail to adjust(e.g., Kodak in digital photography) risk losing market relevance, while those thatinnovate and diversify(e.g., Netflix, Tesla) achieve long-term sustainability.

TESTED 03 Apr 2025

Copyright © 2014-2025 ClapGeek. All Rights Reserved